Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

Government Pension Fund Global Holding of equities at 31 ... - NBIM

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

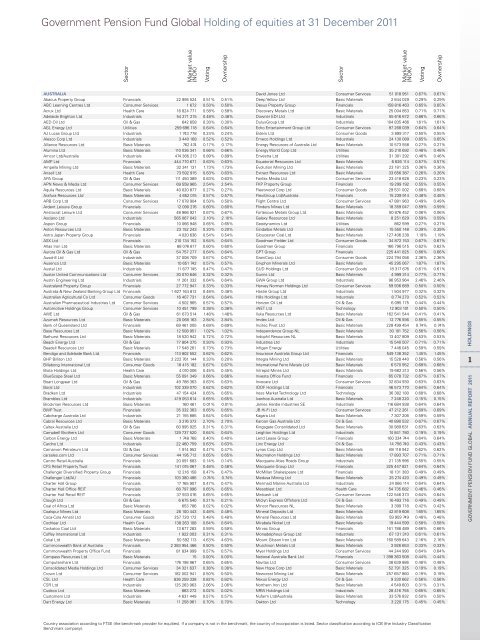

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

AUsTRALiA<br />

abacus Property Group Financials 22 995 524 0.51% 0.51%<br />

abC learning Centres ltd Consumer services 1 672 0.50% 0.50%<br />

acrux ltd Health Care 16 824 771 0.58% 0.58%<br />

adelaide brighton ltd industrials 54 271 215 0.48% 0.48%<br />

aeD oil ltd oil & Gas 642 658 0.30% 0.30%<br />

aGl energy ltd utilities 259 696 118 0.64% 0.64%<br />

aJ lucas Group ltd industrials 1 743 778 0.24% 0.24%<br />

alesco Corp ltd industrials 3 440 168 0.52% 0.52%<br />

alliance resources ltd basic m<strong>at</strong>erials 762 474 0.17% 0.17%<br />

alumina ltd basic m<strong>at</strong>erials 110 036 341 0.66% 0.66%<br />

amcor ltd/australia industrials 474 366 213 0.89% 0.89%<br />

amP ltd Financials 444 770 671 0.63% 0.63%<br />

ampella mining ltd basic m<strong>at</strong>erials 32 341 1<strong>31</strong> 1.73% 1.73%<br />

ansell ltd Health Care 73 592 915 0.63% 0.63%<br />

aPa Group oil & Gas 111 450 389 0.63% 0.63%<br />

aPn news & media ltd Consumer services 69 558 965 2.54% 2.54%<br />

aquila resources ltd basic m<strong>at</strong>erials 40 020 877 0.27% 0.27%<br />

arafura resources ltd basic m<strong>at</strong>erials 4 652 015 0.57% 0.57%<br />

arb Corp ltd Consumer services 17 078 904 0.50% 0.50%<br />

ardent leisure Group Financials 12 090 276 0.60% 0.60%<br />

aristocr<strong>at</strong> leisure ltd Consumer services 48 966 921 0.67% 0.67%<br />

asciano ltd industrials 565 067 042 2.10% 2.10%<br />

aspen Group Financials 10 066 948 0.65% 0.65%<br />

aston resources ltd basic m<strong>at</strong>erials 23 152 243 0.20% 0.20%<br />

astro Japan Property Group Financials 4 020 636 0.54% 0.54%<br />

asX ltd Financials 210 134 152 0.64% 0.64%<br />

<strong>at</strong>las iron ltd basic m<strong>at</strong>erials 88 076 817 0.60% 0.60%<br />

aurora oil & Gas ltd oil & Gas 54 757 277 0.64% 0.64%<br />

ausdrill ltd industrials 37 008 709 0.67% 0.67%<br />

ausenco ltd basic m<strong>at</strong>erials 10 651 742 0.57% 0.57%<br />

austal ltd industrials 11 677 745 0.47% 0.47%<br />

austar united Communic<strong>at</strong>ions ltd Consumer services 30 070 646 0.32% 0.32%<br />

austin engineering ltd industrials 11 261 332 0.64% 0.64%<br />

australand Property Group Financials 27 772 947 0.33% 0.33%<br />

australia & new Zealand banking Group ltd Financials 1 627 164 812 0.48% 0.48%<br />

australian agricultural Co ltd Consumer Goods 16 407 7<strong>31</strong> 0.64% 0.64%<br />

australian Pharmaceutical industries ltd Consumer services 4 502 965 0.57% 0.57%<br />

automotive <strong>Holding</strong>s Group Consumer services 10 451 799 0.38% 0.38%<br />

aWe ltd oil & Gas 61 673 514 1.48% 1.48%<br />

azumah resources ltd basic m<strong>at</strong>erials 20 068 163 2.84% 2.84%<br />

bank <strong>of</strong> Queensland ltd Financials 69 461 005 0.69% 0.69%<br />

base resources ltd basic m<strong>at</strong>erials 12 508 951 1.02% 1.02%<br />

b<strong>at</strong>hurst resources ltd basic m<strong>at</strong>erials 18 520 942 0.72% 0.72%<br />

beach energy ltd oil & Gas 77 804 375 0.93% 0.93%<br />

beadell resources ltd basic m<strong>at</strong>erials 17 548 261 0.73% 0.73%<br />

bendigo and adelaide bank ltd Financials 113 802 552 0.62% 0.62%<br />

bHP billiton ltd basic m<strong>at</strong>erials 2 222 761 144 0.33% 0.20%<br />

billabong intern<strong>at</strong>ional ltd Consumer Goods 18 415 182 0.67% 0.67%<br />

biota <strong>Holding</strong>s ltd Health Care 4 010 006 0.45% 0.45%<br />

bluescope steel ltd basic m<strong>at</strong>erials 55 091 349 0.66% 0.66%<br />

boart longyear ltd oil & Gas 49 788 363 0.63% 0.63%<br />

boral ltd industrials 102 339 070 0.62% 0.62%<br />

bradken ltd industrials 47 154 424 0.65% 0.65%<br />

brambles ltd industrials 419 053 614 0.65% 0.65%<br />

brockman resources ltd basic m<strong>at</strong>erials 160 461 0.01% 0.01%<br />

bWP trust Financials 35 332 363 0.65% 0.65%<br />

Cabcharge australia ltd industrials 21 155 885 0.64% 0.64%<br />

Cabral resources ltd basic m<strong>at</strong>erials 3 276 372 2.70% 2.70%<br />

Caltex australia ltd oil & Gas 60 995 925 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Campbell brothers ltd Consumer Goods 129 737 520 0.64% 0.64%<br />

Carbon energy ltd basic m<strong>at</strong>erials 1 748 768 0.40% 0.40%<br />

Cardno ltd industrials 22 460 759 0.63% 0.63%<br />

Carnarvon Petroleum ltd oil & Gas 1 914 952 0.47% 0.47%<br />

carsales.com ltd Consumer services 44 195 712 0.65% 0.65%<br />

Centro retail australia Financials 20 091 683 0.14% 0.14%<br />

CFs retail Property trust Financials 141 015 067 0.48% 0.48%<br />

Challenger Diversified Property Group Financials 12 216 158 0.47% 0.47%<br />

Challenger ltd/au Financials 103 380 486 0.74% 0.74%<br />

Charter Hall Group Financials 17 765 907 0.47% 0.47%<br />

Charter Hall <strong>of</strong>fice reit Financials 68 797 996 0.65% 0.65%<br />

Charter Hall retail reit Financials 37 933 076 0.65% 0.65%<br />

Clough ltd oil & Gas 6 675 540 0.21% 0.21%<br />

Coal <strong>of</strong> africa ltd basic m<strong>at</strong>erials 653 786 0.02% 0.02%<br />

Coalspur mines ltd basic m<strong>at</strong>erials 26 100 443 0.48% 0.48%<br />

Coca-Cola am<strong>at</strong>il ltd Consumer Goods 257 720 172 0.48% 0.48%<br />

Cochlear ltd Health Care 138 263 108 0.64% 0.64%<br />

Cock<strong>at</strong>oo Coal ltd basic m<strong>at</strong>erials 13 677 283 0.59% 0.59%<br />

C<strong>of</strong>fey intern<strong>at</strong>ional ltd industrials 1 922 003 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Cokal ltd basic m<strong>at</strong>erials 50 592 113 4.63% 4.63%<br />

Commonwealth bank <strong>of</strong> australia Financials 2 383 954 466 0.50% 0.50%<br />

Commonwealth Property <strong>of</strong>fice <strong>Fund</strong> Financials 81 834 999 0.57% 0.57%<br />

Compass resources ltd basic m<strong>at</strong>erials 15 0.00% 0.00%<br />

Computershare ltd Financials 176 198 967 0.65% 0.65%<br />

Consolid<strong>at</strong>ed media <strong>Holding</strong>s ltd Consumer services 34 321 637 0.38% 0.38%<br />

Crown ltd Consumer services 182 002 941 0.50% 0.50%<br />

Csl ltd Health Care 836 259 338 0.82% 0.82%<br />

Csr ltd industrials 125 263 963 2.06% 2.06%<br />

Cudeco ltd basic m<strong>at</strong>erials 863 272 0.02% 0.02%<br />

Customers ltd industrials 4 6<strong>31</strong> 449 0.57% 0.57%<br />

Dart energy ltd basic m<strong>at</strong>erials 11 258 961 0.70% 0.70%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

David Jones ltd Consumer services 51 018 951 0.67% 0.67%<br />

Deep Yellow ltd basic m<strong>at</strong>erials 2 644 029 0.29% 0.29%<br />

Dexus Property Group Financials 158 816 463 0.65% 0.65%<br />

Discovery metals ltd basic m<strong>at</strong>erials 25 004 853 0.71% 0.71%<br />

Downer eDi ltd industrials 55 616 672 0.66% 0.66%<br />

DuluxGroup ltd industrials 104 835 466 1.61% 1.61%<br />

echo entertainment Group ltd Consumer services 97 268 039 0.64% 0.64%<br />

elders ltd Consumer Goods 3 899 <strong>31</strong>7 0.55% 0.55%<br />

emeco <strong>Holding</strong>s ltd industrials 24 130 089 0.65% 0.65%<br />

energy resources <strong>of</strong> australia ltd basic m<strong>at</strong>erials 10 573 558 0.27% 0.27%<br />

energy World Corp ltd utilities 35 210 692 0.48% 0.48%<br />

envestra ltd utilities <strong>31</strong> 301 292 0.46% 0.46%<br />

equ<strong>at</strong>orial resources ltd basic m<strong>at</strong>erials 6 626 114 0.57% 0.57%<br />

evolution mining ltd basic m<strong>at</strong>erials 23 181 325 0.36% 0.36%<br />

extract resources ltd basic m<strong>at</strong>erials 33 656 387 0.26% 0.26%<br />

Fairfax media ltd Consumer services 23 418 628 0.23% 0.23%<br />

FKP Property Group Financials 19 299 192 0.55% 0.55%<br />

Fleetwood Corp ltd Consumer Goods 29 5<strong>31</strong> 002 0.68% 0.68%<br />

FlexiGroup ltd/australia Financials 15 239 914 0.48% 0.48%<br />

Flight Centre ltd Consumer services 47 881 963 0.49% 0.49%<br />

Flinders mines ltd basic m<strong>at</strong>erials 18 359 047 0.59% 0.59%<br />

Fortescue metals Group ltd basic m<strong>at</strong>erials 50 876 452 0.06% 0.06%<br />

Galaxy resources ltd basic m<strong>at</strong>erials 8 251 629 0.59% 0.59%<br />

Geodynamics ltd utilities 862 599 0.27% 0.27%<br />

Gindalbie metals ltd basic m<strong>at</strong>erials 15 550 148 0.39% 0.39%<br />

Gloucester Coal ltd basic m<strong>at</strong>erials 127 406 238 1.19% 1.19%<br />

Goodman Fielder ltd Consumer Goods 34 872 153 0.67% 0.67%<br />

Goodman Group Financials 166 796 515 0.62% 0.62%<br />

GPt Group Financials 225 441 825 0.66% 0.66%<br />

GrainCorp ltd Consumer Goods 224 794 056 2.36% 2.36%<br />

Gryphon minerals ltd basic m<strong>at</strong>erials 45 295 067 1.87% 1.87%<br />

GuD <strong>Holding</strong>s ltd Consumer Goods 18 <strong>31</strong>7 676 0.61% 0.61%<br />

Gunns ltd basic m<strong>at</strong>erials 4 999 <strong>31</strong>4 0.77% 0.77%<br />

GWa Group ltd industrials 96 953 964 2.46% 2.46%<br />

Harvey norman <strong>Holding</strong>s ltd Consumer services 59 936 689 0.50% 0.50%<br />

Hastie Group ltd industrials 1 504 977 0.32% 0.32%<br />

Hills <strong>Holding</strong>s ltd industrials 8 774 270 0.52% 0.52%<br />

Horizon oil ltd oil & Gas 6 095 175 0.44% 0.44%<br />

iinet ltd technology 12 903 101 0.50% 0.50%<br />

iluka resources ltd basic m<strong>at</strong>erials 162 541 544 0.41% 0.41%<br />

imdex ltd oil & Gas 12 776 936 0.55% 0.55%<br />

incitec Pivot ltd basic m<strong>at</strong>erials 228 499 454 0.74% 0.74%<br />

independence Group nl basic m<strong>at</strong>erials 30 101 752 0.56% 0.56%<br />

indophil resources nl basic m<strong>at</strong>erials 13 407 809 0.53% 0.53%<br />

industrea ltd industrials 15 540 507 0.71% 0.71%<br />

infigen energy utilities 7 446 045 0.59% 0.59%<br />

insurance australia Group ltd Financials 549 138 352 1.45% 1.45%<br />

integra mining ltd basic m<strong>at</strong>erials 15 528 440 0.56% 0.56%<br />

intern<strong>at</strong>ional Ferro metals ltd basic m<strong>at</strong>erials 6 570 952 0.68% 0.68%<br />

intrepid mines ltd basic m<strong>at</strong>erials 19 682 <strong>31</strong>3 0.56% 0.56%<br />

investa <strong>of</strong>fice <strong>Fund</strong> Financials 65 078 732 0.67% 0.67%<br />

invocare ltd Consumer services 32 834 930 0.63% 0.63%<br />

iooF <strong>Holding</strong>s ltd Financials 46 573 770 0.64% 0.64%<br />

iress market technology ltd technology 36 382 180 0.68% 0.68%<br />

ivanhoe australia ltd basic m<strong>at</strong>erials 7 248 220 0.15% 0.15%<br />

James Hardie industries se industrials 116 684 938 0.64% 0.64%<br />

Jb Hi-Fi ltd Consumer services 47 212 261 0.69% 0.69%<br />

Kagara ltd basic m<strong>at</strong>erials 7 307 206 0.59% 0.59%<br />

Karoon Gas australia ltd oil & Gas 40 890 532 0.67% 0.67%<br />

Kingsg<strong>at</strong>e Consolid<strong>at</strong>ed ltd basic m<strong>at</strong>erials 30 989 6<strong>31</strong> 0.63% 0.63%<br />

leighton <strong>Holding</strong>s ltd industrials 74 841 780 0.19% 0.19%<br />

lend lease Group Financials 160 334 744 0.64% 0.64%<br />

linc energy ltd oil & Gas 14 756 740 0.43% 0.43%<br />

lynas Corp ltd basic m<strong>at</strong>erials 68 118 942 0.62% 0.62%<br />

macmahon <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 17 893 707 0.71% 0.71%<br />

macquarie <strong>at</strong>las roads Group industrials 21 135 996 0.55% 0.55%<br />

macquarie Group ltd Financials 325 447 821 0.64% 0.64%<br />

mcmillan shakespeare ltd Financials 18 1<strong>31</strong> 383 0.49% 0.49%<br />

medusa mining ltd basic m<strong>at</strong>erials 25 274 420 0.49% 0.49%<br />

mermaid marine australia ltd industrials 24 066 114 0.64% 0.64%<br />

mesoblast ltd Health Care 54 735 682 0.46% 0.46%<br />

metcash ltd Consumer services 122 546 373 0.64% 0.64%<br />

miclyn express <strong>of</strong>fshore ltd oil & Gas 16 493 716 0.49% 0.49%<br />

mincor resources nl basic m<strong>at</strong>erials 3 399 718 0.42% 0.42%<br />

mineral Deposits ltd basic m<strong>at</strong>erials 42 819 608 1.65% 1.65%<br />

mineral resources ltd basic m<strong>at</strong>erials 59 959 749 0.48% 0.48%<br />

mirabela nickel ltd basic m<strong>at</strong>erials 19 444 599 0.58% 0.58%<br />

mirvac Group Financials 161 788 489 0.66% 0.66%<br />

monadelphous Group ltd industrials 67 1<strong>31</strong> <strong>31</strong>0 0.61% 0.61%<br />

mount Gibson iron ltd basic m<strong>at</strong>erials 160 589 643 2.16% 2.16%<br />

murchison metals ltd basic m<strong>at</strong>erials 3 926 653 0.33% 0.33%<br />

myer <strong>Holding</strong>s ltd Consumer services 44 244 990 0.64% 0.64%<br />

n<strong>at</strong>ional australia bank ltd Financials 1 398 363 508 0.44% 0.44%<br />

navitas ltd Consumer services 38 639 886 0.48% 0.48%<br />

new Hope Corp ltd basic m<strong>at</strong>erials 52 791 325 0.19% 0.19%<br />

newcrest mining ltd basic m<strong>at</strong>erials 257 657 860 0.19% 0.19%<br />

nexus energy ltd oil & Gas 9 330 662 0.56% 0.56%<br />

northern iron ltd basic m<strong>at</strong>erials 4 549 603 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

nrW <strong>Holding</strong>s ltd industrials 28 416 755 0.65% 0.65%<br />

nufarm ltd/australia basic m<strong>at</strong>erials 33 576 832 0.50% 0.50%<br />

oakton ltd technology 3 220 175 0.45% 0.45%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

1<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

oil search ltd oil & Gas 498 903 209 0.98% 0.98%<br />

om <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 3 481 693 0.35% 0.35%<br />

onesteel ltd basic m<strong>at</strong>erials 41 487 1<strong>31</strong> 0.72% 0.72%<br />

orica ltd basic m<strong>at</strong>erials 44 700 366 0.08% 0.08%<br />

origin energy ltd utilities 561 722 003 0.63% 0.63%<br />

oZ minerals ltd basic m<strong>at</strong>erials 12 732 448 0.07% 0.07%<br />

Pacific brands ltd Consumer Goods 21 322 673 0.69% 0.69%<br />

Paladin energy ltd basic m<strong>at</strong>erials 41 862 599 0.60% 0.60%<br />

Panaust ltd basic m<strong>at</strong>erials 228 067 075 1.96% 1.96%<br />

Panoramic resources ltd basic m<strong>at</strong>erials 4 507 <strong>31</strong>0 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

PaperlinX ltd basic m<strong>at</strong>erials 1 605 115 0.51% 0.51%<br />

Peet ltd Financials 7 387 433 0.47% 0.47%<br />

Perpetual ltd Financials 36 9<strong>31</strong> 455 0.70% 0.70%<br />

Perseus mining ltd basic m<strong>at</strong>erials 61 299 036 0.92% 0.92%<br />

Pharmaxis ltd Health Care 12 382 476 0.64% 0.64%<br />

Pl<strong>at</strong>inum asset management ltd Financials 29 687 143 0.25% 0.25%<br />

Pl<strong>at</strong>inum australia ltd basic m<strong>at</strong>erials 1 188 955 0.49% 0.49%<br />

Premier investments ltd Financials 41 876 838 0.93% 0.93%<br />

Primary Health Care ltd Health Care 61 425 043 0.65% 0.65%<br />

Primeag australia ltd Consumer Goods 23 302 558 1.34% 1.34%<br />

Programmed maintenance services ltd industrials 8 808 064 0.55% 0.55%<br />

Qantas airways ltd Consumer services 61 900 171 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

Qbe insurance Group ltd Financials 213 926 572 0.24% 0.24%<br />

ramelius resources ltd basic m<strong>at</strong>erials 12 263 588 0.56% 0.56%<br />

ramsay Health Care ltd Health Care 115 913 708 0.49% 0.49%<br />

r<strong>at</strong>el Group ltd basic m<strong>at</strong>erials 1 362 976 0.81% 0.81%<br />

rea Group ltd Financials 25 924 487 0.26% 0.26%<br />

regis resources ltd basic m<strong>at</strong>erials 56 859 445 0.63% 0.63%<br />

reject shop ltd/the Consumer services 7 656 673 0.47% 0.47%<br />

resolute mining ltd basic m<strong>at</strong>erials <strong>31</strong> 566 367 0.65% 0.65%<br />

rex minerals ltd basic m<strong>at</strong>erials 6 976 060 0.53% 0.53%<br />

roc oil Co ltd oil & Gas 4 748 269 0.45% 0.45%<br />

rubicon america trust Financials 498 0.20% 0.20%<br />

sai <strong>Global</strong> ltd industrials 33 6<strong>31</strong> 934 0.60% 0.60%<br />

sandfire resources nl basic m<strong>at</strong>erials 87 138 451 1.43% 1.43%<br />

santos ltd oil & Gas 466 093 7<strong>31</strong> 0.66% 0.66%<br />

saracen mineral <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 16 960 137 0.62% 0.62%<br />

seek ltd industrials 77 855 557 0.67% 0.67%<br />

seven Group <strong>Holding</strong>s ltd Consumer services 26 685 017 0.20% 0.20%<br />

seven West media ltd Consumer services 22 809 5<strong>31</strong> 0.18% 0.18%<br />

sigma Pharmaceuticals ltd Consumer services 25 447 309 0.64% 0.64%<br />

silex systems ltd industrials 18 874 551 0.74% 0.74%<br />

silver lake resources ltd basic m<strong>at</strong>erials 21 290 778 0.52% 0.52%<br />

sims metal management ltd basic m<strong>at</strong>erials 12 574 076 0.08% 0.08%<br />

skilled Group ltd industrials 12 7<strong>31</strong> 573 0.54% 0.54%<br />

sonic Healthcare ltd Health Care 173 476 961 0.64% 0.64%<br />

sP ausnet utilities 57 519 481 0.35% 0.35%<br />

spark infrastructure Group utilities 68 417 393 0.61% 0.61%<br />

spotless Group ltd industrials 52 779 591 1.37% 1.37%<br />

st barbara ltd basic m<strong>at</strong>erials 25 246 036 0.65% 0.65%<br />

stockland Financials 300 970 888 0.67% 0.67%<br />

straits resources ltd basic m<strong>at</strong>erials 8 717 080 0.67% 0.67%<br />

stW Communic<strong>at</strong>ions Group ltd Consumer services 7 827 035 0.42% 0.42%<br />

suncorp Group ltd Financials 426 722 845 0.65% 0.65%<br />

sundance resources ltd basic m<strong>at</strong>erials 42 467 489 0.60% 0.60%<br />

sunland Group ltd Financials 5 194 006 0.64% 0.64%<br />

super retail Group ltd Consumer services 72 918 305 1.16% 1.16%<br />

sydney airport industrials 86 546 895 0.29% 0.29%<br />

tabCorP <strong>Holding</strong>s ltd Consumer services 74 411 429 0.62% 0.62%<br />

tandou ltd Consumer Goods 13 501 577 4.50% 4.50%<br />

tap oil ltd oil & Gas 3 217 <strong>31</strong>8 0.37% 0.37%<br />

t<strong>at</strong>ts Group ltd Consumer services 129 037 756 0.64% 0.64%<br />

telstra Corp ltd telecommunic<strong>at</strong>ions 57 850 366 0.02% 0.02%<br />

ten network <strong>Holding</strong>s ltd Consumer services 25 290 814 0.47% 0.47%<br />

tiger resources ltd basic m<strong>at</strong>erials 9 436 807 0.63% 0.63%<br />

toll <strong>Holding</strong>s ltd industrials 118 555 967 0.64% 0.64%<br />

tPG telecom ltd telecommunic<strong>at</strong>ions 16 505 120 0.26% 0.26%<br />

transfield services ltd industrials 50 748 164 0.70% 0.70%<br />

transpacific industries Group ltd industrials 132 469 865 1.68% 1.68%<br />

transurban Group industrials 427 602 107 0.86% 0.86%<br />

treasury Wine est<strong>at</strong>es ltd Consumer Goods 362 761 132 2.49% 2.49%<br />

troy resources ltd basic m<strong>at</strong>erials 14 730 747 0.64% 0.64%<br />

uGl ltd industrials 80 233 844 0.66% 0.66%<br />

virgin australia <strong>Holding</strong>s ltd Consumer services 23 987 079 0.62% 0.62%<br />

W<strong>at</strong>pac ltd industrials 9 825 005 0.82% 0.82%<br />

Wesfarmers ltd Consumer services 1 347 157 924 0.64% 0.64%<br />

Western areas nl basic m<strong>at</strong>erials 28 583 924 0.51% 0.51%<br />

Westfield Group Financials 552 234 066 0.50% 0.50%<br />

Westfield retail trust Financials 307 363 005 0.66% 0.66%<br />

Westpac banking Corp Financials 1 439 056 756 0.39% 0.39%<br />

White energy Co ltd basic m<strong>at</strong>erials 3 945 723 0.54% 0.54%<br />

Whitehaven Coal ltd basic m<strong>at</strong>erials 50 432 620 0.32% 0.32%<br />

WHK Group ltd Financials 5 805 711 0.43% 0.43%<br />

Woodside Petroleum ltd oil & Gas 985 134 929 0.65% 0.65%<br />

Woolworths ltd Consumer services 1 204 153 435 0.64% 0.64%<br />

WorleyParsons ltd oil & Gas 245 190 859 0.65% 0.65%<br />

Wotif.com <strong>Holding</strong>s ltd Consumer services 17 118 237 0.37% 0.37%<br />

AUsTRiA<br />

andritz aG industrials 435 767 376 1.69% 1.69%<br />

<strong>at</strong>rium european real est<strong>at</strong>e ltd Financials 156 032 013 1.55% 1.55%<br />

bWt aG industrials 7 552 598 0.42% 0.42%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

Ca immobilien anlagen aG Financials 142 650 619 2.53% 2.53%<br />

Conwert immobilien invest se Financials 143 467 963 2.54% 2.54%<br />

erste Group bank aG Financials 570 728 763 1.42% 1.42%<br />

Flughafen Wien aG industrials 45 336 355 0.95% 0.95%<br />

immoFinanZ aG Financials 449 913 019 2.87% 2.87%<br />

intercell aG Health Care 14 341 529 2.01% 2.01%<br />

Kapsch trafficCom aG industrials 45 955 722 0.78% 0.78%<br />

lenzing aG basic m<strong>at</strong>erials 79 257 920 0.58% 0.58%<br />

mayr melnh<strong>of</strong> Karton aG industrials 93 921 100 0.93% 0.93%<br />

oesterreichische Post aG industrials 139 994 243 1.15% 1.15%<br />

omv aG oil & Gas 473 472 218 0.80% 0.80%<br />

Palfinger aG industrials 15 624 024 0.46% 0.46%<br />

raiffeisen bank intern<strong>at</strong>ional aG Financials 193 789 826 0.64% 0.64%<br />

rHi aG industrials 77 792 350 1.67% 1.67%<br />

s immo aG Financials 18 371 418 0.77% 0.77%<br />

schoeller-bleckmann oilfield equipment aG oil & Gas 134 549 142 1.59% 1.59%<br />

semperit aG <strong>Holding</strong> industrials 67 757 561 1.43% 1.43%<br />

strabag se industrials 125 337 421 0.64% 0.64%<br />

telekom austria aG telecommunic<strong>at</strong>ions 1 162 606 525 3.67% 3.67%<br />

verbund aG utilities 291 526 848 0.52% 0.52%<br />

vienna insurance Group aG Wiener<br />

versicherung Gruppe Financials 11 700 508 0.04% 0.04%<br />

voestalpine aG basic m<strong>at</strong>erials 1 032 463 959 3.64% 3.64%<br />

Warimpex Finanz- und beteiligungs aG Financials 8 203 009 2.96% 2.96%<br />

Wienerberger aG industrials 142 191 066 2.24% 2.24%<br />

Zumtobel aG industrials 39 694 470 1.10% 1.10%<br />

BAHRAiN<br />

aluminium bahrain bsC basic m<strong>at</strong>erials 454 144 167 0.00% 3.06%<br />

BELgiUm<br />

ackermans & van Haaren nv Financials 253 304 208 1.69% 1.69%<br />

ageas Financials 1 381 573 488 5.66% 5.87%<br />

aGFa-Gevaert nv industrials 45 395 489 2.77% 2.77%<br />

anheuser-busch inbev nv Consumer Goods 7 100 761 403 1.21% 1.21%<br />

barco nv industrials 70 214 170 1.83% 1.83%<br />

befimmo sCa sicafi Financials 169 467 138 2.39% 2.39%<br />

belgacom sa telecommunic<strong>at</strong>ions 265 391 065 0.42% 0.42%<br />

Cie d’entreprises CFe industrials 84 592 488 2.20% 2.20%<br />

Cie maritime belge sa industrials 50 875 892 1.11% 1.11%<br />

C<strong>of</strong>inimmo Financials 225 712 928 2.10% 2.10%<br />

Colruyt sa Consumer services 379 733 971 1.00% 1.00%<br />

Delhaize Group sa Consumer services 772 694 974 2.26% 2.26%<br />

Dexia sa Financials 40 651 782 0.91% 0.91%<br />

D’ieteren sa/nv Consumer services 160 748 910 1.10% 1.10%<br />

Duvel moortg<strong>at</strong> sa Consumer Goods 4 696 371 0.16% 0.16%<br />

elia system oper<strong>at</strong>or sa/nv utilities 7 647 0.02% 0.02%<br />

euronav nv industrials 12 156 991 0.81% 0.81%<br />

evs broadcast equipment sa industrials 113 485 625 2.72% 2.72%<br />

exmar nv industrials 2 002 0.00% 0.00%<br />

Gimv nv Financials 77 947 046 1.18% 1.18%<br />

Groupe bruxelles lambert sa Financials 958 556 150 1.49% 1.49%<br />

intervest <strong>of</strong>fices & Warehouses Financials 6 037 658 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

ion beam applic<strong>at</strong>ions Health Care 6 407 890 0.63% 0.63%<br />

KbC ancora Financials 18 010 176 0.61% 0.61%<br />

KbC Groep nv Financials 208 <strong>31</strong>4 063 0.77% 0.77%<br />

melexis nv technology 45 762 390 1.32% 1.32%<br />

mobistar sa telecommunic<strong>at</strong>ions 34 696 396 0.18% 0.18%<br />

nv bekaert sa industrials 225 393 606 1.96% 1.96%<br />

nyrstar basic m<strong>at</strong>erials 282 261 728 3.51% 3.51%<br />

omega Pharma Health Care 123 288 552 1.83% 1.83%<br />

recticel sa basic m<strong>at</strong>erials 4 222 892 0.41% 0.41%<br />

rHJ intern<strong>at</strong>ional Financials 40 723 072 1.75% 1.75%<br />

roularta media Group nv Consumer services 13 798 576 0.93% 0.93%<br />

sipef sa Consumer Goods 16 362 828 0.41% 0.41%<br />

s<strong>of</strong>ina sa Financials 183 198 872 1.12% 1.12%<br />

solvay sa basic m<strong>at</strong>erials 448 684 575 1.07% 1.07%<br />

telenet Group <strong>Holding</strong> nv Consumer services 1 168 528 025 4.51% 4.51%<br />

tessenderlo Chemie nv basic m<strong>at</strong>erials 108 947 472 2.32% 2.32%<br />

thromboGenics nv Health Care 95 754 324 2.02% 2.02%<br />

uCb sa Health Care 752 498 953 1.63% 1.63%<br />

umicore sa basic m<strong>at</strong>erials 492 727 632 1.66% 1.66%<br />

van de velde nv Consumer Goods 22 093 478 0.61% 0.61%<br />

Warehouses De Pauw sCa Financials 34 303 032 0.88% 0.88%<br />

Wereldhave belgium nv Financials 5 678 429 0.21% 0.21%<br />

BERmUdA<br />

madagascar oil ltd oil & Gas 9 878 677 2.73% 2.73%<br />

omega insurance <strong>Holding</strong>s ltd Financials 46 114 644 3.70% 3.70%<br />

BRAziL<br />

aes tiete sa utilities 89 278 635 0.29% 0.29%<br />

aliansce shopping Centers sa Financials 68 887 548 1.08% 1.08%<br />

all america l<strong>at</strong>ina logistica sa industrials 1<strong>31</strong> 001 646 0.64% 0.64%<br />

alparg<strong>at</strong>as sa Consumer Goods 375 060 350 0.00% 2.67%<br />

amil Participacoes sa Health Care 9 793 514 0.05% 0.05%<br />

autometal sa industrials 133 387 745 2.39% 2.39%<br />

banco bradesco sa Financials 1 546 605 634 0.00% 0.41%<br />

banco do brasil sa Financials 571 994 138 0.26% 0.26%<br />

banco santander brasil sa/brazil Financials 488 386 729 0.27% 0.27%<br />

bm&Fbovespa sa Financials 329 905 778 0.53% 0.53%<br />

br malls Participacoes sa Financials 226 943 842 0.87% 0.87%<br />

br Properties sa Financials 12 286 6<strong>31</strong> 0.12% 0.12%<br />

bradespar sa Financials 415 462 743 0.00% 1.17%<br />

brasil telecom sa telecommunic<strong>at</strong>ions 234 628 407 0.00% 1.12%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

2<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

brF - brasil Foods sa Consumer Goods 463 109 607 0.42% 0.46%<br />

Camargo Correa Desenvolvimento<br />

imobiliario sa Financials 4 390 360 0.30% 0.30%<br />

CCr sa industrials 148 213 043 0.21% 0.21%<br />

Centrais eletricas brasileiras sa utilities 102 294 205 0.16% 0.13%<br />

CetiP sa - balcao organizado de <strong>at</strong>ivos<br />

e Deriv<strong>at</strong>ivos Financials 62 491 297 0.29% 0.29%<br />

Cia de bebidas das americas Consumer Goods 1 156 786 086 0.00% 0.17%<br />

Cia de Gas de sao Paulo utilities 26 247 669 0.00% 0.16%<br />

Cia de saneamento de minas Gerais-CoPasa utilities 13 472 550 0.11% 0.11%<br />

Cia energetica de sao Paulo utilities 754 551 683 0.00% 2.18%<br />

Cia Ferro ligas da bahia - Ferbasa basic m<strong>at</strong>erials 115 843 021 0.00% 4.99%<br />

Cia Hering Consumer Goods 612 0<strong>31</strong> 357 3.61% 3.61%<br />

Cia Paranaense de energia utilities 345 626 864 0.25% 1.03%<br />

Cia Providencia industria e Comercio sa basic m<strong>at</strong>erials 19 837 175 1.25% 1.25%<br />

Cielo sa Financials 469 025 932 0.56% 0.56%<br />

Confab industrial sa basic m<strong>at</strong>erials 179 013 041 0.00% 3.<strong>31</strong>%<br />

Cosan ltd Consumer Goods 24 232 889 0.03% 0.14%<br />

Cosan sa industria e Comercio Consumer Goods 388 983 235 1.11% 1.11%<br />

Cr2 empreendimentos imobiliarios sa Financials 26 989 697 2.97% 2.97%<br />

Diagnosticos da america sa Health Care 186 454 465 1.21% 1.21%<br />

Dur<strong>at</strong>ex sa industrials 28 064 660 0.18% 0.18%<br />

ecorodovias infraestrutura e logistica sa industrials 14 822 342 0.06% 0.06%<br />

eDP - energias do brasil sa utilities 398 104 126 1.89% 1.89%<br />

embraer sa industrials 59 554 243 0.21% 0.21%<br />

equ<strong>at</strong>orial energia sa utilities 177 429 817 4.01% 4.01%<br />

euc<strong>at</strong>ex sa industria e Comercio industrials 21 084 997 0.00% 1.08%<br />

even Construtora e incorporadora sa Financials 99 649 649 2.16% 2.16%<br />

ez tec empreendimentos e Participacoes sa Financials 148 949 8<strong>31</strong> 2.01% 2.01%<br />

Gerdau sa basic m<strong>at</strong>erials 518 975 737 0.14% 0.66%<br />

Helbor empreendimentos sa Financials 122 539 994 2.84% 2.84%<br />

Hrt Participacoes em Petroleo sa oil & Gas 27 805 320 0.26% 0.26%<br />

Hypermarcas sa Consumer Goods 140 309 087 0.82% 0.82%<br />

iochpe-maxion sa Consumer Goods 351 485 772 4.59% 4.59%<br />

itau unibanco <strong>Holding</strong> sa Financials 1 946 489 614 0.01% 0.39%<br />

itausa - investimentos itau sa Financials 1 <strong>31</strong>7 823 852 0.00% 0.83%<br />

Klabin sa industrials 73 534 026 0.00% 0.<strong>31</strong>%<br />

light sa utilities 389 737 607 2.07% 2.07%<br />

llX logistica sa industrials 442 230 739 5.91% 5.91%<br />

localiza rent a Car sa Consumer services 139 562 627 0.84% 0.84%<br />

lojas americanas sa Consumer services 152 869 755 0.00% 0.43%<br />

lojas renner sa Consumer services 28 364 220 0.15% 0.15%<br />

lup<strong>at</strong>ech sa oil & Gas 15 469 984 2.28% 2.28%<br />

m Dias branco sa Consumer Goods 116 100 070 0.67% 0.67%<br />

mahle-metal leve sa industria e Comercio Consumer Goods 32 932 062 0.57% 0.57%<br />

marcopolo sa industrials 397 650 482 0.00% 3.91%<br />

marfrig alimentos sa Consumer Goods 38 371 027 0.40% 0.40%<br />

metalfrio solutions sa Consumer Goods 18 213 406 2.50% 2.50%<br />

metalurgica Gerdau sa basic m<strong>at</strong>erials 2 271 066 0.00% 0.01%<br />

millennium inorganic Chemicals do brasil sa basic m<strong>at</strong>erials 46 153 426 0.00% 4.44%<br />

multiplan empreendimentos imobiliarios sa Financials 137 440 264 0.67% 0.63%<br />

multiplus sa Consumer services 436 584 242 2.62% 2.62%<br />

n<strong>at</strong>ura Cosmeticos sa Consumer Goods 768 174 665 1.54% 1.54%<br />

obrascon Huarte lain brasil sa industrials 133 544 237 0.99% 0.99%<br />

oGX Petroleo e Gas Participacoes sa oil & Gas 201 606 255 0.14% 0.14%<br />

osX brasil sa oil & Gas 79 185 082 0.77% 0.77%<br />

Parana banco sa Financials 20 851 533 0.00% 0.69%<br />

PDG realty sa empreendimentos<br />

e Participacoes Financials 277 526 379 1.<strong>31</strong>% 1.<strong>31</strong>%<br />

Petroleo brasileiro sa oil & Gas 6 868 568 282 0.40% 0.74%<br />

Porto seguro sa Financials 22 302 456 0.10% 0.10%<br />

Positivo inform<strong>at</strong>ica sa technology 9 757 507 0.60% 0.60%<br />

QGeP Participacoes sa oil & Gas 38 484 874 0.27% 0.27%<br />

randon Participacoes sa industrials 54 447 723 0.00% 0.82%<br />

redecard sa Financials 550 466 015 0.88% 0.88%<br />

santos brasil Participacoes sa industrials 150 282 288 0.00% 1.45%<br />

sao Carlos empreendimentos<br />

e Participacoes sa Financials 14 170 973 0.32% 0.32%<br />

sao martinho sa Consumer Goods 85 756 148 1.42% 1.42%<br />

schulz sa Consumer Goods 81 588 380 0.00% 4.00%<br />

slC agricola sa Consumer Goods 51 995 566 1.06% 1.06%<br />

sonae sierra brasil sa Financials 48 051 217 0.82% 0.82%<br />

suzano Papel e Celulose sa basic m<strong>at</strong>erials 65 134 883 0.00% 0.74%<br />

tam sa Consumer services 97 052 135 0.00% 0.54%<br />

technos sa Consumer Goods 118 582 815 3.08% 3.08%<br />

tecnisa sa Consumer Goods 168 336 036 2.82% 2.82%<br />

tele norte leste telecommunic<strong>at</strong>ions 188 585 719 0.80% 0.63%<br />

telefonica brasil sa telecommunic<strong>at</strong>ions 1 2<strong>31</strong> 796 353 0.00% 0.66%<br />

telemar norte leste sa telecommunic<strong>at</strong>ions 15 301 833 0.00% 0.03%<br />

tim Participacoes sa telecommunic<strong>at</strong>ions 103 473 263 0.14% 0.14%<br />

tPi - triunfo Participacoes e investimentos sa industrials 187 444 947 4.27% 4.27%<br />

tractebel energia sa utilities 150 161 430 0.24% 0.24%<br />

tupy sa basic m<strong>at</strong>erials 74 393 481 1.47% 1.46%<br />

ultrapar Participacoes sa utilities 260 606 945 0.47% 0.47%<br />

usinas siderurgicas de minas Gerais sa basic m<strong>at</strong>erials 25 038 514 0.00% 0.08%<br />

vale sa basic m<strong>at</strong>erials 3 508 679 724 0.38% 0.53%<br />

valid solucoes e servicos de seguranca em<br />

meios de Pagamento e identificacao s.a industrials <strong>31</strong> 387 530 0.81% 0.81%<br />

Weg sa industrials 51 716 961 0.14% 0.14%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

CANAdA<br />

advantage oil & Gas ltd oil & Gas 27 201 947 0.66% 0.66%<br />

aecon Group inc industrials 25 472 673 0.74% 0.74%<br />

aGF management ltd Financials 61 271 768 0.00% 0.69%<br />

agnico-eagle mines ltd basic m<strong>at</strong>erials 251 789 115 0.68% 0.68%<br />

agrium inc basic m<strong>at</strong>erials 816 168 426 1.29% 1.29%<br />

alacer Gold Corp basic m<strong>at</strong>erials 116 732 147 0.68% 0.68%<br />

alamos Gold inc basic m<strong>at</strong>erials 85 328 191 0.70% 0.70%<br />

algonquin Power & utilities Corp utilities 12 109 181 0.24% 0.24%<br />

aliment<strong>at</strong>ion Couche tard inc Consumer services 158 686 790 0.13% 0.48%<br />

allied Properties real est<strong>at</strong>e investment<br />

trust Financials 53 891 291 0.71% 0.71%<br />

altaGas ltd oil & Gas 107 727 683 0.65% 0.63%<br />

arC resources ltd oil & Gas 224 104 433 0.53% 0.53%<br />

artis real est<strong>at</strong>e investment trust Financials 48 691 952 0.67% 0.67%<br />

astral media inc Consumer services 77 204 290 0.00% 0.67%<br />

<strong>at</strong>co ltd/Canada utilities 125 098 647 0.00% 0.61%<br />

<strong>at</strong>habasca oil sands Corp oil & Gas 198 856 608 0.68% 0.68%<br />

<strong>at</strong>lantic Power Corp utilities 64 222 211 0.67% 0.67%<br />

<strong>at</strong>rium innov<strong>at</strong>ions inc Consumer Goods 9 472 613 0.42% 0.42%<br />

<strong>at</strong>s autom<strong>at</strong>ion tooling systems inc industrials 23 096 534 0.70% 0.70%<br />

aura minerals inc basic m<strong>at</strong>erials 7 054 445 0.42% 0.42%<br />

aurico Gold inc basic m<strong>at</strong>erials 89 942 444 0.67% 0.67%<br />

aurizon mines ltd basic m<strong>at</strong>erials <strong>31</strong> 961 134 0.67% 0.67%<br />

avion Gold Corp basic m<strong>at</strong>erials 21 277 284 0.51% 0.51%<br />

azure Dynamics Corp oil & Gas 1 410 520 0.47% 0.47%<br />

b2Gold Corp basic m<strong>at</strong>erials 27 584 303 0.40% 0.40%<br />

ballard Power systems inc oil & Gas 39 972 0.01% 0.01%<br />

bank <strong>of</strong> montreal Financials 1 406 418 452 0.67% 0.67%<br />

bank <strong>of</strong> nova scotia Financials 2 180 386 755 0.67% 0.67%<br />

bankers Petroleum ltd oil & Gas 88 988 287 1.38% 1.38%<br />

banro Corp basic m<strong>at</strong>erials 24 976 819 0.57% 0.57%<br />

baytex energy Corp oil & Gas 181 941 342 0.46% 0.46%<br />

bCe inc telecommunic<strong>at</strong>ions 250 881 808 0.13% 0.13%<br />

bell aliant inc telecommunic<strong>at</strong>ions 59 525 005 0.16% 0.16%<br />

bioexx specialty Proteins ltd basic m<strong>at</strong>erials 937 758 0.44% 0.44%<br />

birchcliff energy ltd oil & Gas 71 457 027 0.71% 0.71%<br />

blackPearl resources inc oil & Gas 45 611 823 0.67% 0.67%<br />

boardwalk real est<strong>at</strong>e investment trust Financials 98 071 102 0.64% 0.64%<br />

bombardier inc industrials 237 895 226 0.29% 0.57%<br />

bonavista energy Corp oil & Gas 106 484 248 0.49% 0.43%<br />

bonterra energy Corp oil & Gas 37 199 722 0.64% 0.64%<br />

brookfield asset management inc Financials 696 212 471 0.68% 0.68%<br />

brookfield <strong>of</strong>fice Properties inc Financials 237 5<strong>31</strong> 245 0.50% 0.50%<br />

Cae inc industrials 103 842 905 0.70% 0.70%<br />

Calfrac Well services ltd oil & Gas 34 932 183 0.48% 0.48%<br />

Calloway real est<strong>at</strong>e investment trust Financials 110 862 369 0.57% 0.57%<br />

Cameco Corp basic m<strong>at</strong>erials 297 037 282 0.70% 0.70%<br />

Canaccord Financial inc Financials 26 122 544 0.68% 0.68%<br />

Canadian apartment Properties reit Financials 71 690 244 0.65% 0.65%<br />

Canadian imperial bank <strong>of</strong> Commerce/Canada Financials 1 154 748 <strong>31</strong>3 0.67% 0.67%<br />

Canadian n<strong>at</strong>ional railway Co industrials 1 018 183 786 0.49% 0.49%<br />

Canadian n<strong>at</strong>ural resources ltd oil & Gas 1 901 347 015 0.78% 0.78%<br />

Canadian oil sands ltd oil & Gas 298 794 183 0.45% 0.45%<br />

Canadian Pacific railway ltd industrials 467 304 809 0.68% 0.68%<br />

Canadian real est<strong>at</strong>e investment trust Financials 93 061 981 0.67% 0.67%<br />

Canadian tire Corp ltd Consumer services 207 966 164 0.00% 0.66%<br />

Canadian utilities ltd utilities 213 360 769 0.00% 0.46%<br />

Canadian Western bank Financials 75 027 585 0.66% 0.66%<br />

Canfor Corp basic m<strong>at</strong>erials 48 220 695 0.54% 0.54%<br />

Capital Power Corp utilities 33 420 754 0.00% 0.46%<br />

Capstone mining Corp basic m<strong>at</strong>erials 41 115 715 0.67% 0.67%<br />

Cardiome Pharma Corp Health Care 7 405 134 0.77% 0.77%<br />

Cascades inc basic m<strong>at</strong>erials 14 772 368 0.60% 0.60%<br />

CCl industries inc industrials 36 747 928 0.00% 0.60%<br />

Celestica inc industrials 58 911 741 0.20% 0.62%<br />

Celtic explor<strong>at</strong>ion ltd oil & Gas 94 219 672 0.67% 0.67%<br />

Cenovus energy inc oil & Gas 1 012 210 768 0.68% 0.68%<br />

Centerra Gold inc basic m<strong>at</strong>erials 129 321 799 0.52% 0.52%<br />

CGa mining ltd basic m<strong>at</strong>erials 26 496 491 0.66% 0.66%<br />

CGi Group inc technology 175 763 892 0.28% 0.60%<br />

Chartwell seniors Housing real est<strong>at</strong>e<br />

investment trust Financials 51 652 553 0.72% 0.72%<br />

China Gold intern<strong>at</strong>ional resources Corp ltd basic m<strong>at</strong>erials 45 447 261 0.80% 0.80%<br />

Chinook energy inc oil & Gas 10 342 234 0.51% 0.51%<br />

Ci Financial Corp Financials 182 377 651 0.52% 0.52%<br />

Cineplex inc Consumer services 37 933 669 0.43% 0.43%<br />

Clifton star resources inc basic m<strong>at</strong>erials 30 392 207 5.94% 5.94%<br />

Cml HealthCare inc Health Care 35 062 935 0.69% 0.69%<br />

Cogeco Cable inc Consumer services 69 246 167 0.12% 0.47%<br />

Cominar real est<strong>at</strong>e investment trust Financials 58 305 222 0.59% 0.59%<br />

Connacher oil and Gas ltd oil & Gas 22 054 080 1.10% 1.10%<br />

Corridor resources inc oil & Gas 105 876 0.02% 0.02%<br />

Corus entertainment inc Consumer services 63 958 2<strong>31</strong> 0.00% 0.64%<br />

Cott Corp Consumer Goods 22 846 184 0.64% 0.64%<br />

Crescent Point energy Corp oil & Gas 509 458 447 0.67% 0.67%<br />

Crew energy inc oil & Gas 140 770 812 1.78% 1.78%<br />

Davis & Henderson Corp industrials 39 345 534 0.67% 0.67%<br />

Denison mines Corp basic m<strong>at</strong>erials 18 272 413 0.64% 0.64%<br />

Detour Gold Corp basic m<strong>at</strong>erials 99 267 925 0.68% 0.68%<br />

Dollarama inc Consumer services 126 804 077 0.66% 0.66%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

3<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

Dorel industries inc Consumer Goods 29 611 961 0.28% 0.62%<br />

Dundee Corp Financials 45 473 109 0.21% 0.62%<br />

Dundee Precious metals inc basic m<strong>at</strong>erials 168 598 771 2.79% 2.79%<br />

Dundee real est<strong>at</strong>e investment trust Financials 85 915 995 0.65% 0.65%<br />

eastern Pl<strong>at</strong>inum ltd basic m<strong>at</strong>erials 18 975 020 0.66% 0.66%<br />

eldorado Gold Corp basic m<strong>at</strong>erials 304 946 417 0.67% 0.67%<br />

emera inc utilities 160 163 <strong>31</strong>2 0.68% 0.68%<br />

empire Co ltd Consumer services 79 985 014 0.00% 0.34%<br />

enbridge inc oil & Gas 629 448 191 0.36% 0.36%<br />

encana Corp oil & Gas 474 032 293 0.58% 0.58%<br />

endeavour silver Corp basic m<strong>at</strong>erials 28 050 849 0.55% 0.55%<br />

enerflex ltd oil & Gas 39 600 383 0.66% 0.66%<br />

enerplus Corp oil & Gas 151 942 095 1.<strong>31</strong>% 0.55%<br />

ensign energy services inc oil & Gas 102 478 881 0.70% 0.70%<br />

entertainment one ltd Consumer services 80 054 432 2.02% 2.02%<br />

european Goldfields ltd basic m<strong>at</strong>erials 89 249 565 0.70% 0.70%<br />

extendicare real est<strong>at</strong>e investment trust Financials 30 <strong>31</strong>5 038 0.72% 0.72%<br />

Fairborne energy ltd oil & Gas 12 856 712 0.72% 0.72%<br />

Fairfax Financial <strong>Holding</strong>s ltd Financials 349 406 216 0.39% 0.64%<br />

Finning intern<strong>at</strong>ional inc industrials 153 572 594 0.69% 0.69%<br />

First Capital realty inc Financials 44 961 618 0.26% 0.26%<br />

First majestic silver Corp basic m<strong>at</strong>erials 63 293 227 0.60% 0.60%<br />

First n<strong>at</strong>ional Financial Corp Financials 11 973 346 0.20% 0.20%<br />

First Quantum minerals ltd basic m<strong>at</strong>erials 380 822 873 0.68% 0.68%<br />

Firstservice Corp/Canada Financials <strong>31</strong> 574 767 0.36% 0.67%<br />

Flint energy services ltd oil & Gas 97 732 794 2.72% 2.72%<br />

Fortis inc/Canada utilities 247 921 973 0.68% 0.68%<br />

Franco-nevada Corp Financials 400 217 877 1.27% 1.27%<br />

Gabriel resources ltd basic m<strong>at</strong>erials 49 200 614 0.35% 0.35%<br />

Genworth mi Canada inc Financials 43 829 964 0.37% 0.37%<br />

George Weston ltd Consumer services 138 722 722 0.27% 0.27%<br />

Gibson energy inc oil & Gas 37 195 519 0.36% 0.36%<br />

Gildan activewear inc Consumer Goods 94 107 508 0.69% 0.69%<br />

GmP Capital inc Financials 20 423 687 0.70% 0.70%<br />

Goldcorp inc basic m<strong>at</strong>erials 1 069 468 546 0.47% 0.50%<br />

Golden star resources ltd basic m<strong>at</strong>erials 17 044 520 0.67% 0.67%<br />

Gre<strong>at</strong> basin Gold ltd basic m<strong>at</strong>erials 17 728 764 0.67% 0.67%<br />

Gre<strong>at</strong> Canadian Gaming Corp Consumer services 29 861 177 0.74% 0.74%<br />

Gre<strong>at</strong>-West lifeco inc Financials 229 873 766 0.20% 0.20%<br />

Groupe aeroplan inc Consumer services 86 888 167 0.71% 0.71%<br />

Guide explor<strong>at</strong>ion ltd oil & Gas 139 794 0.01% 0.01%<br />

Guyana Goldfields inc basic m<strong>at</strong>erials 87 976 741 2.39% 2.39%<br />

GWr <strong>Global</strong> W<strong>at</strong>er resources Corp utilities 7 123 911 3.98% 3.98%<br />

H&r real est<strong>at</strong>e investment trust Financials 153 146 801 0.65% 0.65%<br />

Hanfeng evergreen inc basic m<strong>at</strong>erials 151 007 0.02% 0.02%<br />

Harry Winston Diamond Corp basic m<strong>at</strong>erials 27 883 041 0.52% 0.52%<br />

Home Capital Group inc Financials 66 925 116 0.67% 0.67%<br />

HomeQ Corp Financials 1 122 0.00% 0.00%<br />

Hudbay minerals inc basic m<strong>at</strong>erials 72 000 771 0.70% 0.70%<br />

Husky energy inc oil & Gas 327 228 196 0.24% 0.24%<br />

iamGolD Corp basic m<strong>at</strong>erials 239 159 407 0.67% 0.67%<br />

iGm Financial inc Financials 226 188 517 0.34% 0.34%<br />

imax Corp Consumer services 46 613 342 0.66% 0.66%<br />

imperial metals Corp basic m<strong>at</strong>erials 65 609 940 1.21% 1.21%<br />

imperial oil ltd oil & Gas 613 552 632 0.27% 0.27%<br />

industrial alliance insurance & Financial<br />

services inc Financials 93 437 201 0.67% 0.67%<br />

inmet mining Corp basic m<strong>at</strong>erials 178 368 202 0.67% 0.67%<br />

innergex renewable energy inc utilities 22 743 284 0.46% 0.46%<br />

innvest real est<strong>at</strong>e investment trust Financials 14 344 499 0.63% 0.63%<br />

intact Financial Corp Financials 302 940 403 0.68% 0.68%<br />

ithaca energy inc oil & Gas 50 269 368 1.55% 1.55%<br />

ivanhoe mines ltd/Ca basic m<strong>at</strong>erials 207 600 735 0.26% 0.26%<br />

Jaguar mining inc basic m<strong>at</strong>erials 24 749 451 0.77% 0.77%<br />

Jean Coutu Group PJC inc/the Consumer services 54 333 829 0.06% 0.32%<br />

Just energy Group inc utilities 45 907 509 0.49% 0.47%<br />

K<strong>at</strong>anga mining ltd basic m<strong>at</strong>erials 16 818 033 0.13% 0.13%<br />

Keegan resources inc basic m<strong>at</strong>erials 9 903 990 0.58% 0.58%<br />

Keyera Corp oil & Gas 62 513 287 0.30% 0.30%<br />

Kinross Gold Corp basic m<strong>at</strong>erials 727 806 455 0.94% 0.94%<br />

Kirkland lake Gold inc basic m<strong>at</strong>erials 137 266 779 2.17% 2.17%<br />

Kulczyk oil ventures inc oil & Gas 32 174 723 3.79% 3.79%<br />

labrador iron mines <strong>Holding</strong>s ltd basic m<strong>at</strong>erials 25 164 854 1.59% 1.59%<br />

lake shore Gold Corp basic m<strong>at</strong>erials 18 696 222 0.62% 0.62%<br />

laurentian bank <strong>of</strong> Canada Financials 43 479 900 0.65% 0.65%<br />

legacy oil + Gas inc oil & Gas 60 099 843 0.68% 0.68%<br />

linamar Corp Consumer Goods 32 953 059 0.62% 0.62%<br />

loblaw Cos ltd Consumer services 173 334 387 0.27% 0.27%<br />

lundin mining Corp basic m<strong>at</strong>erials 65 602 956 0.50% 0.50%<br />

macDonald Dettwiler & associ<strong>at</strong>es ltd industrials 58 298 463 0.66% 0.66%<br />

magna intern<strong>at</strong>ional inc Consumer Goods <strong>31</strong>8 244 455 0.68% 0.68%<br />

major Drilling Group intern<strong>at</strong>ional oil & Gas 47 980 624 0.67% 0.67%<br />

manitoba telecom services inc telecommunic<strong>at</strong>ions 24 501 874 0.21% 0.21%<br />

manulife Financial Corp Financials <strong>31</strong>1 386 214 0.27% 0.27%<br />

maple leaf Foods inc Consumer Goods 42 821 985 0.48% 0.42%<br />

martinrea intern<strong>at</strong>ional inc Consumer Goods 24 240 702 0.67% 0.67%<br />

meG energy Corp oil & Gas 407 153 7<strong>31</strong> 0.87% 0.87%<br />

melcor Developments ltd Financials 3 341 829 0.14% 0.14%<br />

merc<strong>at</strong>or minerals ltd basic m<strong>at</strong>erials 14 639 129 0.67% 0.67%<br />

methanex Corp basic m<strong>at</strong>erials 85 719 384 0.67% 0.67%<br />

metro inc Consumer services 219 578 619 0.62% 0.68%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

midas Gold Corp basic m<strong>at</strong>erials 32 834 456 1.35% 1.35%<br />

minefinders Corp basic m<strong>at</strong>erials 35 020 653 0.68% 0.68%<br />

molson Coors Canada inc Consumer Goods 7 <strong>31</strong>4 554 0.00% 0.12%<br />

morguard real est<strong>at</strong>e investment trust Financials 27 778 640 0.51% 0.51%<br />

mullen Group ltd industrials 64 153 748 0.69% 0.69%<br />

nal energy Corp oil & Gas 34 249 651 0.49% 0.49%<br />

n<strong>at</strong>ional bank <strong>of</strong> Canada Financials 462 976 589 0.68% 0.68%<br />

nautilus minerals inc basic m<strong>at</strong>erials 42 199 106 2.04% 2.04%<br />

neo m<strong>at</strong>erial technologies inc basic m<strong>at</strong>erials 27 632 752 0.55% 0.55%<br />

nevsun resources ltd basic m<strong>at</strong>erials 74 085 743 1.12% 1.12%<br />

new Gold inc basic m<strong>at</strong>erials 182 001 058 0.67% 0.67%<br />

nexen inc oil & Gas 339 232 463 0.68% 0.68%<br />

nGex resources inc basic m<strong>at</strong>erials 16 952 963 0.68% 0.68%<br />

niko resources ltd oil & Gas 97 484 005 0.67% 0.67%<br />

norbord inc industrials 5 232 346 0.25% 0.25%<br />

nordion inc Health Care 22 270 507 0.71% 0.71%<br />

north West Co inc/the Consumer services 22 143 896 0.39% 0.39%<br />

northern Dynasty minerals ltd basic m<strong>at</strong>erials 16 144 983 0.47% 0.47%<br />

northland Power inc utilities 23 898 053 0.29% 0.29%<br />

novagold resources inc basic m<strong>at</strong>erials 64 929 373 0.53% 0.53%<br />

nuvista energy ltd oil & Gas 20 256 001 0.66% 0.66%<br />

oceanaGold Corp basic m<strong>at</strong>erials 22 214 599 0.64% 0.64%<br />

onex Corp industrials 158 226 187 0.70% 0.70%<br />

open text Corp technology 115 635 645 0.65% 0.65%<br />

orezone Gold Corp basic m<strong>at</strong>erials 49 326 066 3.83% 3.83%<br />

osisko mining Corp basic m<strong>at</strong>erials 222 293 926 1.00% 1.00%<br />

Pacific rubiales energy Corp oil & Gas 245 085 329 0.82% 0.82%<br />

Paladin labs inc Health Care 8 593 385 0.17% 0.17%<br />

Pan american silver Corp basic m<strong>at</strong>erials 93 981 087 0.68% 0.68%<br />

Paramount resources ltd oil & Gas 70 573 727 0.33% 0.33%<br />

Pason systems inc oil & Gas 30 390 530 0.53% 0.53%<br />

Pembina Pipeline Corp utilities 195 998 642 0.67% 0.67%<br />

Pengrowth energy Corp oil & Gas 74 836 796 0.33% 0.33%<br />

Penn West Petroleum ltd oil & Gas 250 626 556 0.45% 0.45%<br />

Petrobakken energy ltd oil & Gas 36 937 706 0.26% 0.26%<br />

Petrobank energy & resources ltd oil & Gas 43 379 620 0.66% 0.66%<br />

Petrominerales ltd oil & Gas 163 134 411 1.66% 1.66%<br />

Peyto explor<strong>at</strong>ion & Development Corp oil & Gas 90 977 905 0.46% 0.46%<br />

Power Corp <strong>of</strong> Canada Financials 386 691 556 0.<strong>31</strong>% 0.60%<br />

Power Financial Corp Financials 288 590 337 0.27% 0.27%<br />

Precision Drilling Corp oil & Gas 117 655 205 0.69% 0.69%<br />

Pretium resources inc basic m<strong>at</strong>erials 201 354 645 3.16% 3.16%<br />

Primaris retail real est<strong>at</strong>e investment trust Financials 63 332 426 0.65% 0.65%<br />

Progress energy resources Corp oil & Gas 123 667 633 0.69% 0.69%<br />

Progressive Waste solutions ltd industrials 607 557 463 4.34% 4.34%<br />

Provident energy ltd oil & Gas 42 226 559 0.27% 0.27%<br />

Quadra FnX mining ltd basic m<strong>at</strong>erials 113 924 359 0.67% 0.67%<br />

Quebecor inc industrials 59 574 228 0.12% 0.46%<br />

reitmans Canada ltd Consumer services 34 636 920 0.00% 0.61%<br />

research in motion ltd technology 323 494 756 0.71% 0.71%<br />

rioCan real est<strong>at</strong>e investment trust Financials 281 902 843 0.67% 0.67%<br />

ritchie bros auctioneers inc industrials 111 773 835 0.80% 0.80%<br />

rogers Communic<strong>at</strong>ions inc telecommunic<strong>at</strong>ions 22 747 415 0.00% 0.02%<br />

romarco minerals inc basic m<strong>at</strong>erials 151 916 783 4.11% 4.11%<br />

rona inc Consumer services 51 751 953 0.69% 0.69%<br />

royal bank <strong>of</strong> Canada Financials 2 953 225 530 0.67% 0.67%<br />

rubicon minerals Corp basic m<strong>at</strong>erials 38 433 367 0.71% 0.71%<br />

russel metals inc basic m<strong>at</strong>erials 56 359 413 0.71% 0.71%<br />

saputo inc Consumer Goods 235 388 655 0.51% 0.51%<br />

savanna energy services Corp oil & Gas 25 337 158 0.68% 0.68%<br />

seabridge Gold inc basic m<strong>at</strong>erials 27 963 880 0.67% 0.67%<br />

semaFo inc basic m<strong>at</strong>erials 73 870 566 0.70% 0.70%<br />

shaw Communic<strong>at</strong>ions inc Consumer services 329 647 194 0.00% 0.63%<br />

shawCor ltd oil & Gas 66 370 618 0.21% 0.56%<br />

sherritt intern<strong>at</strong>ional Corp basic m<strong>at</strong>erials 62 879 383 0.66% 0.66%<br />

shoppers Drug mart Corp Consumer services 215 286 818 0.42% 0.42%<br />

sierra Wireless inc technology 7 923 849 0.60% 0.60%<br />

silver standard resources inc basic m<strong>at</strong>erials 43 853 120 0.66% 0.66%<br />

silver Whe<strong>at</strong>on Corp basic m<strong>at</strong>erials 413 658 476 0.68% 0.68%<br />

silvercorp metals inc basic m<strong>at</strong>erials 45 689 996 0.70% 0.70%<br />

sinopec Daylight energy ltd ltd oil & Gas 2 557 906 0.02% 0.02%<br />

smart technologies inc technology 5 377 708 0.03% 0.20%<br />

snC-lavalin Group inc industrials 304 573 744 0.67% 0.67%<br />

southGobi resources ltd basic m<strong>at</strong>erials 9 530 176 0.15% 0.15%<br />

sprott inc Financials 9 536 141 0.17% 0.17%<br />

stantec inc industrials 50 879 028 0.69% 0.69%<br />

sun life Financial inc Financials 260 499 509 0.40% 0.40%<br />

suncor energy inc oil & Gas 1 762 339 301 0.65% 0.65%<br />

superior Plus Corp Consumer services 26 606 919 0.72% 0.72%<br />

sXC Health solutions Corp technology 140 032 121 0.67% 0.67%<br />

tahoe resources inc basic m<strong>at</strong>erials 33 014 671 0.22% 0.22%<br />

talisman energy inc oil & Gas 1 041 562 463 1.33% 1.33%<br />

taseko mines ltd basic m<strong>at</strong>erials 20 548 2<strong>31</strong> 0.64% 0.64%<br />

teck resources ltd basic m<strong>at</strong>erials 928 154 014 0.29% 0.75%<br />

telus Corp telecommunic<strong>at</strong>ions 169 652 001 0.01% 0.16%<br />

thompson Creek metals Co inc basic m<strong>at</strong>erials 46 166 568 0.66% 0.66%<br />

thomson reuters Corp Consumer services <strong>31</strong>6 064 966 0.24% 0.24%<br />

tim Hortons inc Consumer services 309 034 289 0.68% 0.68%<br />

tmX Group inc Financials 170 496 051 0.94% 0.94%<br />

toromont industries ltd industrials 63 671 203 0.66% 0.66%<br />

toronto-Dominion bank/the Financials 2 710 822 186 0.67% 0.67%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

4<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

torstar Corp Consumer services 23 987 822 0.00% 0.62%<br />

tourmaline oil Corp oil & Gas 84 <strong>31</strong>6 814 0.34% 0.34%<br />

transalta Corp utilities 185 514 055 0.67% 0.67%<br />

trans<strong>at</strong> <strong>at</strong> inc Consumer services 9 721 121 0.64% 0.62%<br />

transCanada Corp oil & Gas 1 653 437 369 0.90% 0.90%<br />

transcontinental inc industrials 34 517 325 0.13% 0.58%<br />

transForce inc industrials 46 701 895 0.64% 0.64%<br />

trican Well service ltd oil & Gas 104 168 911 0.69% 0.69%<br />

trilogy energy Corp oil & Gas 93 834 649 0.50% 0.37%<br />

trinidad Drilling ltd oil & Gas 38 258 408 0.70% 0.70%<br />

uranium one inc basic m<strong>at</strong>erials 42 <strong>31</strong>4 445 0.35% 0.35%<br />

valeant Pharmaceuticals intern<strong>at</strong>ional inc Health Care 598 908 027 0.72% 0.72%<br />

veresen inc oil & Gas 49 088 939 0.29% 0.29%<br />

vermilion energy inc oil & Gas 173 495 455 0.68% 0.68%<br />

viterra inc Consumer Goods 161 048 452 0.69% 0.69%<br />

West Fraser timber Co ltd basic m<strong>at</strong>erials 48 799 036 0.47% 0.47%<br />

Western Wind energy Corp utilities 17 891 173 2.89% 2.89%<br />

Westport innov<strong>at</strong>ions inc industrials 108 716 535 1.13% 1.13%<br />

Wi-lan inc technology 27 571 257 0.65% 0.65%<br />

Yamana Gold inc basic m<strong>at</strong>erials 443 134 461 0.68% 0.68%<br />

Yellowhead mining inc basic m<strong>at</strong>erials 8 138 713 3.27% 4.90%<br />

CAymAN isLANds<br />

endeavour mining Corp basic m<strong>at</strong>erials 10 476 181 0.29% 0.29%<br />

CHiLE<br />

administradora de Fondos de <strong>Pension</strong>es<br />

Provida sa Financials 6 162 181 0.07% 0.07%<br />

aes Gener sa utilities 77 860 327 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

banco de Chile Financials 141 679 975 0.20% 0.20%<br />

banco de Credito e inversiones Financials 79 724 735 0.23% 0.23%<br />

banco santander Chile Financials 105 818 412 0.13% 0.13%<br />

besalco sa industrials 5 611 708 0.12% 0.12%<br />

CaP sa basic m<strong>at</strong>erials 241 981 870 0.74% 0.74%<br />

Cencosud sa Consumer services 245 742 723 0.32% 0.32%<br />

CFr Pharmaceuticals sa Health Care 99 742 450 0.00% 0.84%<br />

Cia Cervecerias unidas sa Consumer Goods 86 677 483 0.35% 0.35%<br />

Cia sud americana de vapores sa industrials 19 585 764 0.19% 0.19%<br />

Colbun sa utilities 67 101 911 0.25% 0.25%<br />

Corpbanca Financials 92 206 051 0.48% 0.48%<br />

e.Cl sa utilities 70 979 463 0.42% 0.42%<br />

embotelladora andina sa Consumer Goods 27 545 911 0.04% 0.14%<br />

empresa nacional de electricidad sa/Chile utilities 291 757 874 0.30% 0.40%<br />

empresas CmPC sa basic m<strong>at</strong>erials 109 901 804 0.23% 0.23%<br />

empresas CoPeC sa oil & Gas 235 097 324 0.23% 0.23%<br />

empresas Hites sa Consumer services 5 912 529 0.42% 0.42%<br />

empresas la Polar sa Consumer services 21 594 247 2.61% 2.61%<br />

enaex sa basic m<strong>at</strong>erials 13 <strong>31</strong>8 721 0.17% 0.17%<br />

enersis sa utilities 228 361 419 0.24% 0.33%<br />

entel Chile sa telecommunic<strong>at</strong>ions 96 546 966 0.37% 0.37%<br />

inversiones aguas metropolitanas sa utilities 25 577 321 0.28% 0.28%<br />

lan airlines sa Consumer services 153 335 908 0.32% 0.32%<br />

madeco sa technology 5 346 730 0.27% 0.27%<br />

masisa sa industrials 8 535 063 0.23% 0.23%<br />

norte Grande sa Financials 3 581 216 0.07% 0.07%<br />

Parque arauco sa Financials 5 141 427 0.08% 0.08%<br />

Quinenco sa industrials 9 302 870 0.05% 0.05%<br />

saCi Falabella Consumer services 346 476 429 0.<strong>31</strong>% 0.<strong>31</strong>%<br />

sociedad Quimica y minera de Chile sa basic m<strong>at</strong>erials 199 705 141 0.24% 0.24%<br />

vina Concha y toro sa Consumer Goods 12 621 005 0.15% 0.15%<br />

CHiNA<br />

21vianet Group inc technology 54 606 743 2.02% 1.76%<br />

acheng relay Co ltd industrials 702 614 0.04% 0.04%<br />

advanced technology & m<strong>at</strong>erials Co ltd basic m<strong>at</strong>erials 4 691 202 0.03% 0.03%<br />

aeolus tyre Co ltd Consumer Goods 483 457 0.02% 0.02%<br />

aerospace Communic<strong>at</strong>ions <strong>Holding</strong> Co ltd Consumer Goods 481 692 0.02% 0.02%<br />

aerospace Hi-tech <strong>Holding</strong>s Grp ltd Consumer Goods 780 445 0.03% 0.03%<br />

aier eye Hospital Group Co ltd Health Care 37 852 0.00% 0.00%<br />

air China ltd Consumer services 4 293 996 0.01% 0.01%<br />

aisino Co ltd industrials 22 237 767 0.13% 0.13%<br />

aluminum Corp <strong>of</strong> China ltd basic m<strong>at</strong>erials 9 297 479 0.01% 0.01%<br />

an Hui Wenergy Co ltd utilities 390 733 0.01% 0.01%<br />

andon Health Co ltd Health Care 8 714 0.00% 0.00%<br />

angang steel Co ltd basic m<strong>at</strong>erials 192 544 835 0.62% 0.62%<br />

angel Yeast Co ltd Consumer Goods 1 285 566 0.01% 0.01%<br />

anhui Conch Cement Co ltd industrials <strong>31</strong>4 411 092 0.34% 0.34%<br />

anhui expressway Co industrials 530 785 0.01% 0.01%<br />

anhui Golden seed Winery Co ltd Consumer Goods 2 485 138 0.03% 0.03%<br />

anhui Gu<strong>of</strong>eng Plastic industry Co ltd basic m<strong>at</strong>erials 640 621 0.04% 0.04%<br />

anhui Heli Co ltd-a industrials 9 172 597 0.22% 0.22%<br />

anhui Hengyuan Coal-electricity Group Co ltd basic m<strong>at</strong>erials 2 394 659 0.02% 0.02%<br />

anhui Huamao textile Co Consumer Goods 721 665 0.01% 0.01%<br />

anhui Huaxing Chemical industry Co ltd basic m<strong>at</strong>erials 276 494 0.02% 0.02%<br />

anhui Jianghuai automobile Co ltd Consumer Goods 1 741 151 0.02% 0.02%<br />

anhui shanying Paper industry Co ltd basic m<strong>at</strong>erials 506 018 0.02% 0.02%<br />

anhui ustC iFlytek Co ltd technology 5 595 840 0.07% 0.07%<br />

anhui Wanwei upd<strong>at</strong>ed High-tech m<strong>at</strong>erial<br />

industry Co ltd basic m<strong>at</strong>erials 583 801 0.02% 0.02%<br />

anhui Xinke new m<strong>at</strong>erials Co ltd basic m<strong>at</strong>erials 1 514 283 0.06% 0.06%<br />

anhui Zhongding sealing Parts Co ltd industrials 1 122 210 0.02% 0.02%<br />

anXin trust & investment Co ltd Financials 1 474 403 0.03% 0.03%<br />

anyang iron & steel Co ltd basic m<strong>at</strong>erials 1 297 489 0.02% 0.02%<br />

asia Cement China <strong>Holding</strong>s Corp industrials 14 183 690 0.33% 0.33%<br />

voting<br />

ownership<br />

sector<br />

market value<br />

(noK)<br />

aviC aero-engine Controls Co ltd industrials 877 965 0.01% 0.01%<br />

avic Heavy machinery Co ltd industrials 922 892 0.01% 0.01%<br />

baidu inc/China technology 1 079 024 772 0.15% 0.45%<br />

bank <strong>of</strong> China ltd Financials 380 340 997 0.06% 0.06%<br />

baoding swan Co ltd basic m<strong>at</strong>erials 641 847 0.02% 0.02%<br />

baoding tianwei baobian electric Co ltd industrials 3 471 245 0.02% 0.02%<br />

baoji titanium industry Co ltd basic m<strong>at</strong>erials 1 135 043 0.02% 0.02%<br />

baoshan iron & steel Co ltd basic m<strong>at</strong>erials 42 729 093 0.05% 0.05%<br />

baosheng science and technology<br />

innov<strong>at</strong>ion Co ltd industrials 437 423 0.02% 0.02%<br />

baotou Huazi industry Co ltd Consumer Goods 596 491 0.02% 0.02%<br />

baotou tomorrow technology <strong>Holding</strong> Co ltd basic m<strong>at</strong>erials 538 898 0.05% 0.05%<br />

baoxin auto Group ltd Consumer services 76 466 939 0.52% 0.52%<br />

baoye Group Co ltd industrials 74 857 362 4.09% 4.09%<br />

bbmG Corp industrials 17 676 000 0.10% 0.10%<br />

beihai Yinhe Hi-tech industrial Co ltd industrials 506 100 0.03% 0.03%<br />

beijing aerospace Changfeng Co ltd industrials 835 968 0.04% 0.04%<br />

beijing bashi media Co ltd Consumer services 403 666 0.01% 0.01%<br />

beijing Capital Co ltd utilities 1 619 907 0.01% 0.01%<br />

beijing Capital intern<strong>at</strong>ional airport Co ltd industrials 168 093 929 1.30% 1.30%<br />

beijing Capital retailing Group Co ltd Consumer services 913 409 0.01% 0.01%<br />

beijing Dabeinong technology Group Co ltd Consumer Goods 1 766 396 0.01% 0.01%<br />

beijing Dinghan technology Co ltd technology 17 001 0.00% 0.00%<br />

beijing Double Crane Pharmaceutical Co ltd Health Care 2 327 057 0.03% 0.03%<br />

beijing enterprises <strong>Holding</strong>s ltd industrials 528 114 397 1.30% 1.30%<br />

beijing enterprises W<strong>at</strong>er Group ltd utilities 32 580 676 0.29% 0.29%<br />

beijing Gehua C<strong>at</strong>v network Co ltd Consumer services 2 247 069 0.03% 0.03%<br />

beijing Haohua energy resource Co ltd basic m<strong>at</strong>erials 2 100 480 0.01% 0.01%<br />

beijing Hualian Hypermarket Consumer services 875 148 0.02% 0.02%<br />

beijing Jingkelong Co ltd Consumer services 37 245 245 1.78% 1.78%<br />

beijing new building m<strong>at</strong>erial PlC industrials 866 656 0.01% 0.01%<br />

beijing orient landscape Co ltd industrials 1 974 146 0.02% 0.02%<br />

beijing sanyuan Foods Co ltd Consumer Goods 441 182 0.01% 0.01%<br />

beijing shiji inform<strong>at</strong>ion technology Co ltd technology 694 851 0.01% 0.01%<br />

beijing shougang Co ltd basic m<strong>at</strong>erials 914 <strong>31</strong>2 0.01% 0.01%<br />

beijing shunxin agriculture Co Consumer Goods 709 559 0.01% 0.01%<br />

beijing sJ environmental Protection and<br />

new m<strong>at</strong>erial Co ltd basic m<strong>at</strong>erials 14 593 0.00% 0.00%<br />

beijing sl Pharmaceutical Co ltd Health Care 1 855 066 0.02% 0.02%<br />

beijing teamsun technology Co ltd technology 698 028 0.01% 0.01%<br />

beijing tiantan biological Products Co Health Care 1 157 248 0.01% 0.01%<br />

beijing tongrentang Co ltd Health Care 2 805 272 0.02% 0.02%<br />

beijing Wangfujing Department store<br />

Group Co ltd Consumer services 12 274 058 0.09% 0.09%<br />

beijing Yanjing brewery-a Consumer Goods 2 373 402 0.02% 0.02%<br />

beijing Zhongke sanhuan High-tech Co ltd industrials 23 878 060 0.25% 0.25%<br />

beiqi Foton motor Co ltd Consumer Goods 3 548 670 0.03% 0.03%<br />

better life Commercial Chain share Co ltd Consumer services 513 915 0.01% 0.01%<br />

blue star new Chemical m<strong>at</strong>erial Co ltd basic m<strong>at</strong>erials 772 545 0.02% 0.02%<br />

boe technology Group Co ltd industrials 2 725 538 0.01% 0.01%<br />

boer Power <strong>Holding</strong>s ltd industrials 26 187 487 2.06% 2.06%<br />

bohai leasing Co ltd industrials 1 786 335 0.02% 0.02%<br />

bright Dairy & Food Co ltd Consumer Goods 848 636 0.01% 0.01%<br />

bright oceans inter-telecom Corp technology 1 869 601 0.05% 0.05%<br />

brilliance China automotive <strong>Holding</strong>s ltd Consumer Goods 497 615 764 1.54% 1.54%<br />

byd Co ltd industrials 88 991 297 0.29% 0.29%<br />

Canal scientific & technological Co ltd Consumer Goods 583 605 0.03% 0.03%<br />

Celestial nutrifoods ltd Consumer Goods 1 327 0.45% 0.45%<br />

Centre testing intern<strong>at</strong>ional shenzhen Co ltd industrials 13 844 247 0.45% 0.45%<br />

Chang Jiang runfa machinery Co ltd industrials 4 760 0.00% 0.00%<br />

Chang Jiang shipping Group Phoenix Co ltd industrials 746 <strong>31</strong>2 0.04% 0.04%<br />

Changchai Co ltd industrials 469 263 0.02% 0.02%<br />

Changchun eurasia Group Co ltd Consumer services <strong>31</strong> 253 044 0.78% 0.78%<br />

Changchun Faway automobile<br />

Components Co ltd Consumer Goods 1 297 133 0.03% 0.03%<br />

Changchun Gas Co ltd basic m<strong>at</strong>erials 1 333 392 0.04% 0.04%<br />

Changchun High & new technology<br />

industries inc Health Care 1 712 145 0.04% 0.04%<br />

Changchunjingkai Group Co ltd utilities 671 341 0.04% 0.04%<br />

Changfeng axle China Co industrials 6 108 662 1.08% 1.08%<br />

Changjiang & Jingong steel building<br />

Group Co ltd industrials 964 344 0.02% 0.02%<br />

Changlin Co ltd industrials 814 973 0.03% 0.03%<br />

Changsha tongcheng <strong>Holding</strong>s Co ltd Consumer services 658 495 0.03% 0.03%<br />

Changyuan Group ltd industrials 1 485 636 0.03% 0.03%<br />

Chengdu b-ray media Co ltd Consumer services 1 710 348 0.02% 0.02%<br />

Chengdu Dr Peng telecom & media<br />

Group Co ltd technology 930 143 0.01% 0.01%<br />

Chengdu Xingrong investment Co ltd basic m<strong>at</strong>erials 3 302 876 0.04% 0.04%<br />

Chengshang Group Co ltd Consumer services 1 257 393 0.04% 0.04%<br />

Chengzhi Co ltd Health Care 698 571 0.03% 0.03%<br />

Chenzhou mining Group Co ltd basic m<strong>at</strong>erials 28 <strong>31</strong>4 928 0.27% 0.27%<br />

China aerospace times electronics Co ltd industrials 1 926 712 0.03% 0.03%<br />

China agri-industries <strong>Holding</strong>s ltd Consumer Goods 233 977 681 1.28% 1.28%<br />

China animal Husbandry industry Co Health Care 1 100 774 0.02% 0.02%<br />

China avi<strong>at</strong>ion optical-electrical<br />

technology Co ltd industrials 1 755 114 0.03% 0.03%<br />

China CamC engineering Co ltd industrials 2 379 178 0.02% 0.02%<br />

China CiFCo investment Co ltd Consumer services 1 032 086 0.04% 0.04%<br />

China Cnr Corp ltd industrials 5 229 849 0.02% 0.02%<br />

China Coal energy Co ltd basic m<strong>at</strong>erials 351 148 122 0.40% 0.40%<br />

Country associ<strong>at</strong>ion according to Ftse (the benchmark provider for <strong>equities</strong>). if a company is not in the benchmark, the country <strong>of</strong> incorpor<strong>at</strong>ion is listed. sector classific<strong>at</strong>ion according to iCb (the industry Classific<strong>at</strong>ion<br />

benchmark company).<br />

voting<br />

ownership<br />

HOLdiNgs<br />

5<br />

<strong>Government</strong> <strong>Pension</strong> FunD <strong>Global</strong> ANNUAL REPORT 2011

<strong>Government</strong> <strong>Pension</strong> <strong>Fund</strong> <strong>Global</strong> <strong>Holding</strong> <strong>of</strong> <strong>equities</strong> <strong>at</strong> <strong>31</strong> December 2011<br />

sector<br />

market value<br />

(noK)<br />

China Communic<strong>at</strong>ions Construction Co ltd industrials 154 988 759 0.22% 0.22%<br />

China Construction bank Corp Financials 718 835 972 0.07% 0.07%<br />

China CosCo <strong>Holding</strong>s Co ltd industrials 1 812 748 0.00% 0.00%<br />

China CssC <strong>Holding</strong>s ltd industrials 2 586 676 0.01% 0.01%<br />

China CYts tours <strong>Holding</strong> Co ltd Consumer services 1 815 339 0.03% 0.03%<br />

China Dalian intern<strong>at</strong>ional Cooper<strong>at</strong>ion<br />

Group Co industrials 645 006 0.03% 0.03%<br />

China D<strong>at</strong>ang Corp renewable Power Co ltd utilities 84 255 848 1.07% 1.07%<br />

China Dongfanghong spaces<strong>at</strong> Co ltd technology 2 738 380 0.02% 0.02%<br />

China eastern airlines Corp ltd Consumer services 4 586 915 0.01% 0.01%<br />

China enterprise Co ltd Financials 1 220 038 0.02% 0.02%<br />

China erzhong Group Deyang Heavy<br />

equipment Co ltd industrials 1 286 987 0.01% 0.01%<br />

China everbright intern<strong>at</strong>ional ltd industrials 10 302 626 0.13% 0.13%<br />

China Fangda Group Co ltd industrials 482 640 0.02% 0.02%<br />

China Fiberglass Co ltd basic m<strong>at</strong>erials 1 044 078 0.01% 0.01%<br />

China First Heavy industries Co ltd industrials 3 082 506 0.02% 0.02%<br />

China Foods ltd Consumer Goods 78 123 092 0.60% 0.60%<br />

China Forestry <strong>Holding</strong>s Co ltd basic m<strong>at</strong>erials 5 169 247 0.75% 0.75%<br />

China Gezhouba Group Co ltd industrials 7 683 226 0.03% 0.03%<br />

China Gre<strong>at</strong>wall Computer shenzhen Co ltd technology 1 370 217 0.02% 0.02%<br />

China Hongqiao Group ltd basic m<strong>at</strong>erials 373 298 477 1.98% 1.98%<br />

China Hongxing sports ltd Consumer Goods 9 518 366 0.64% 0.64%<br />

China Hydroelectric Corp utilities 603 358 0.06% 0.17%<br />

China intern<strong>at</strong>ional marine Containers<br />

Group Co ltd industrials 60 330 951 0.20% 0.20%<br />

China intern<strong>at</strong>ional travel service Corp ltd Consumer services 2 803 084 0.01% 0.01%<br />

China Jialing industrial Co ltd Consumer Goods 630 816 0.02% 0.02%<br />

China life insurance Co ltd Financials 412 932 165 0.10% 0.10%<br />

China lodging Group ltd Consumer services 12 042 249 0.24% 0.24%<br />

China longyuan Power Group Corp oil & Gas 260 898 806 0.75% 0.75%<br />

China medical technologies inc Health Care 13 557 860 2.47% 2.47%<br />

China merchants bank Co ltd Financials 248 136 987 0.10% 0.10%<br />

China merchants energy shipping Co ltd industrials 1 723 759 0.02% 0.02%<br />

China milk Products Group ltd Consumer Goods 1 713 0.50% 0.50%<br />

China ming Yang Wind Power Group ltd oil & Gas 3 115 745 0.18% 0.18%<br />

China minsheng banking Corp ltd Financials 78 867 623 0.06% 0.06%<br />

China minzhong Food Corp ltd Consumer Goods 17 791 524 0.85% 0.85%<br />

China mobile ltd telecommunic<strong>at</strong>ions 41 992 189 0.00% 0.00%<br />

China modern Dairy <strong>Holding</strong>s ltd Consumer Goods 24 359 588 0.40% 0.40%<br />

China molybdenum Co ltd basic m<strong>at</strong>erials 153 751 408 1.24% 1.24%<br />

China n<strong>at</strong>ional accord medicines Corp ltd Health Care 749 028 0.01% 0.01%<br />

China n<strong>at</strong>ional building m<strong>at</strong>erial Co ltd industrials 937 273 117 2.56% 2.56%<br />

China n<strong>at</strong>ional Complete Plant import &<br />

export Co ltd industrials 1 291 671 0.05% 0.05%<br />

China n<strong>at</strong>ional medicines Corp ltd Health Care 1 232 386 0.02% 0.02%<br />

China n<strong>at</strong>ional s<strong>of</strong>tware & service Co ltd technology 345 902 0.01% 0.01%<br />

China nonferrous metal industry’s Foreign<br />

engineering and Construction Co ltd basic m<strong>at</strong>erials 4 305 435 0.03% 0.03%<br />

China north optical-electrical<br />