What is Letter of Credit(LC)?

One of the best definition of LC is as follows.

“A promise by a bank on behalf of the buyer (customer/importer) to pay the seller (beneficiary/exporter) a specified sum in the agreed currency, provided that the seller submits the required documents by a predetermined deadline”

A letter of credit or LC is a written document issued by the importer’s bank (opening bank) on importer’s behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.In case the purchaser fails to make the payment to the seller, then the bank will need to pay the entire amount or the outstanding amount that originally needs to be paid by the purchaser.

The primary aim of this instrument is to provide increased assurance to both the buyer and seller of the fulfilment of each party’s obligations in a commercial trade – namely the seller’s obligation to deliver the goods as agreed with the buyer, and the buyer’s obligation to pay for those goods within the specified timeframe. Whenever a letter of credit is issued, the products that are ordered by the buyer will be in possession of the bank. Until the buyer either makes the full payment or makes a payment to the bank for all the documents with an undertaking that the bank will take full responsibility, the possession of the products will not be released by the bank to the purchaser.

Features of Letter of Credit

Negotiability

A letter of credit is a transactional deal, under which the terms can be modified/changed at the parties assent. In order to be negotiable, a letter of credit should include an unconditional promise of payment upon demand or at a particular point in time.

Revocability

A letter of credit can be revocable or irrevocable. Since a revocable letter of credit cannot be confirmed, the duty to pay can be revoked at any point of time. In an irrevocable letter of credit, all the parties hold power, it cannot be changed/modified without the agreed consent of all the people.

Transfer and Assignment

A letter of credit can be transferred, also the beneficiary has the right to transfer/assign the LC. The LC will remain effective no matter how many times the beneficiary assigns/transfers the LC.

Sight & Time Drafts

The beneficiary will only receive the payment upon maturity of letter of credit from the issuing bank when he presents all the drafts & the necessary documents.

Documents required for a Letter of Credit

Bill of Lading / Airway Bill

Commercial Invoice

Insurance Certificate

Certificate of Origin

Packing List

Certificate of Inspection

Main parties Involved in LC

Applicant An applicant (buyer) is a person who requests his bank to issue a letter of credit.

Beneficiary A beneficiary is basically the seller who receives his payment under the process.

Issuing bank, the issuing bank (also called an opening bank) is responsible for issuing the letter of credit at the request of the buyer.

Advising bank, the advising bank is responsible for the transfer of documents to the issuing bank on behalf of the exporter and is generally located in the country of the exporter.

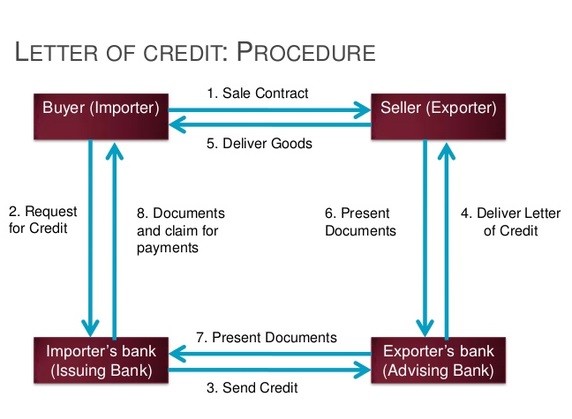

LC Process

Step 1 - Issuance of LC

After the parties to the trade agree on the contract and the use of LC, the importer applies to the issuing bank to issue an LC in favor of the exporter. The LC is sent by the issuing bank to the advising bank. The latter is generally based in the exporter’s country and may even be the exporter’s bank. The advising bank (confirming bank) verifies the authenticity of the LC and forwards it to the exporter.

Step 2 - Shipping of goods

After receipt of the LC, the exporter is expected to verify the same to their satisfaction and initiate the goods shipping process.

Step 3 - Providing Documents to the confirming bank

After the goods are shipped, the exporter (either on their own or through the freight forwarder) presents the documents to the advising/confirming bank.

Step 4 - Settlement of payment from importer and possession of goods

The bank, in turn, sends them to the issuing bank and the amount is paid, accepted, or negotiated, as the case may be. The issuing bank verifies the documents and obtains payment from the importer. It sends the documents to the importer, who uses them to get possession of the shipped goods.

Letter of Credit Discrepancies

Discrepancy can be defined as an error or defect, according to the issuing bank, in the presented documents compared to the documentary credit, the UCP 600 rules(Uniform Customs and Practice for Documentary Credits) or other documents that have been presented under the same letter of credit. Discrepancies create problems especially for the exporters.

Once the documents are rejected, the issuing banks can only pay the credit amount, if and only if the importers accept the discrepancies.

Common causes of LC Discrepancy

1. Letter of credit has expired

2. Late presentation of documents

3. Late shipment of goods

4. Inconsistent spelling of parties’ names in documents

5. Terms of sale not complied with

6. Merchandise description not strictly as per L/C term

7. Partial shipment or transshipment effected despite L/C terms

8. Foreign language documents must be exactly as per L/C

9. Documents are not consistent with one another

10. Ocean Bill of Lading issued by forwarding agent unacceptable

11. Bills of Lading not clean

12. Insurance does not cover risks stipulated in L/C

13. Insurance issued after shipment date

14. Bills of Lading and Drafts not properly endorsed

15. Drafts not completed properly

How can reduce discrepancy rates:

Improved drafting of LC's by issuing banks.

Thorough review of LC's by advising / confirming banks to understand the risks and implications.

Beneficiaries to clearly understand the implications of providing certain documents and ensure they can meet timeframes and deadlines.

Close and constant communication between beneficiary and logistics / document providers.

Liaison between all parties in case of unforeseen problems: beneficiary / applicant / banks.

Senior Procurement Supervisor chez Responsible Mining Services (RMS AFRICA)

2yYes this one of the stape more difficult and flexible