Types of Marine Insurance Policies Institute Clause A, B,C and Claiming Procedure.

What is Marine Insurance?

Marine Insurance is a type of Insurance policy that provided coverage against any damage/loss caused to cargo vessels, ships, terminals or transfer.

Marine insurance is called as protection against future loss. Marine insurance is important because through marine insurance the owners can be sure of claiming damages by considering the mode of transportation. There are four modes of transport – air, road, rail, and water. Out of which water is the riskiest way of transportation, where it causes huge financial casket of the transporter.

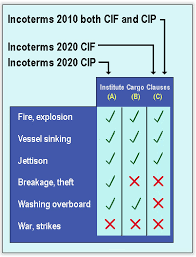

There are 3 types of marine cargo insurance policies available for international transactions.

These marine cargo insurance policy types are known as Institute Cargo Clauses (A), Institute Cargo Clauses (B) and Institute Cargo Clauses (C).

Each marine cargo policy type covers different amount of risks, whereas Institute Cargo Clauses (C) has the minimum coverage, Institute Cargo Clauses (B) has the medium coverage and Institute Cargo Clauses (A), also known as all risks, has the maximum coverage.

Institute Cargo Clauses (C):

Institute Cargo Clauses (C) covers very limited risks most of them which must be happen during the carriage in forms of accidents. Below you can find the details of the risk coverage of this type of insurance policy.

Loss of or damage to the subject-matter insured reasonably attributable to

• Fire or explosion

• Vessel or craft being stranded, grounded, sunk or capsized

• Overturning or derailment of land conveyance

• Collision or contact of vessel craft or conveyance with any external object other than water

• Discharge of cargo at a port of distress

Loss of or damage to the subject-matter insured caused by

• General average sacrifice

• Jettison

Definitions: General Average Sacrifice: There is a general average act when, and only when, any extraordinary sacrifice or expenditure is intentionally and reasonably made or incurred for the common safety for the purpose of preserving from peril the property involved in a common maritime adventure.

Jettison: The intentional throwing overboard of part of the cargo or some piece of the ship in order to save the ship or its cargo.

Institute Cargo Clauses (B):

Institute Cargo Clauses (B) is the medium cover cargo insurance policy available in the market. ICC (B) cargo insurance covers more risks than ICC (C) cargo clauses but covers less risks than ICC (A) All Risks insurance policies.

Below you can find the details of the risk coverage of ICC (B) insurance policy.

Loss of or damage to the subject-matter insured reasonably attributable to

• Fire or explosion

• Vessel or craft being stranded, grounded, sunk or capsized

• Overturning or derailment of land conveyance

• Collision or contact of vessel craft or conveyance with any external object other than water

• Discharge of cargo at a port of distress,

• EEarthquake volcanic eruption or lightning,

Loss of or damage to the subject-matter insured caused by

• General average sacrifice

• Jettison

• Entry of sea lake or river water into vessel craft hold conveyance container or place of storage

• Total loss of any package lost overboard or dropped whilst loading on to, or unloading from, vessel or craft.

Institute Cargo Clauses (A):

Institute Cargo Clauses (A) covers maximum risks as a result it is also known as All Risks cargo insurance policy. Below you can find the details of the risk coverage of this type of insurance policy.

Insurance Cargo Clauses (A) covers all the risks of loss of or damage to the goods except following conditions:

General Exclusion Clauses

• Loss damage or expense attributable to willful misconduct of the Assured

• Ordinary leakage, ordinary loss in weight or volume, or ordinary wear and tear of the subject-matter insured

• Loss damage or expense caused by insufficiency or unsuitability of packing or preparation of the subject matter insured to withstand the ordinary incidents of the insured transit where such packing or preparation is carried out by the Assured or their employees or prior to the attachment of this insurance (for the purpose of these Clauses "packing" shall be deemed to include stowage in a container and "employees" shall not include independent contractors)

• Loss damage or expense caused by inherent vice or nature of the subject-matter insured

• Loss, damage or expense caused by delay, even though the delay be caused by a risk insured against

• Loss, damage or expense caused by insolvency or financial default of the owners, managers, charterers or operators of the vessel where, at the time of loading of the subject-matter insured on board the vessel, the Assured are aware, or in the ordinary course of business should be aware, that such insolvency or financial default could prevent the normal prosecution of the voyage. This exclusion shall not apply where the contract of insurance has been assigned to the party claiming hereunder who has bought or agreed to buy the subject-matter insured in good faith under a binding contract

• Loss, damage or expense directly or indirectly caused by or arising from the use of any weapon or device employing atomic or nuclear fission and/or fusion or other like reaction or radioactive force or matter.

Exclusion Clauses Covering Insufficiency of the Vessel or Containers etc.

• Loss damage or expense arising from unseaworthiness of vessel or craft or unfitness of vessel or craft for the safe carriage of the subject-matter insured, where the Assured are privy to such unseaworthiness or unfitness, at the time the subject-matter insured is loaded therein

• Loss damage or expense arising from unfitness of container or conveyance for the safe carriage of the subject-matter insured, where loading therein or thereon is carried out prior to attachment of this insurance or by the Assured or their employees and they are privy to such unfitness at the time of loading.

Exclusion Clauses Covering War related Risks

• Loss damage or expense caused by war civil war revolution rebellion insurrection, or civil strife arising therefrom, or any hostile act by or against a belligerent power.

• Loss damage or expense caused by capture seizure arrest restraint or detainment (piracy excepted), and the consequences thereof or any attempt thereat.

• Loss damage or expense caused by derelict mines, torpedoes, bombs or other derelict weapons of war.

Exclusion Clauses Covering Strikes, Riots and Civil Commotions Risks

• Loss damage or expense caused by strikers, locked-out workmen, or persons taking part in labour disturbances, riots or civil commotions.

• Loss damage or expense resulting from strikes, lock-outs, labour disturbances, riots or civil commotions.

PROCESS FOR CLAIMING MARINE INSURANCE

TO APPROACH THE INSURER

The first step is to intimate the insurer about the loss or damage of goods and the details of the event. If the marine insurance was purchased through a broker it is important to communicate to them. The insurer will check all the safety measures to transport the goods. It is easy to proceed with the claim. Once the claim is placed, it is necessary to collect the acknowledgement letter from the insurer.

TO INFORM THE SHIPPING COMPANY

At the same time, it is also significant to inform the shipping company regarding the loss or damage of goods. It is necessary to ensure and convey the facts accurately to the shipping company and also the insurer. In case of theft, or no – delivery of goods, the file has to be lodged compulsorily.

DETAILED SURVEY

By receiving the claim notification from the insured, the insurance provider appoints a surveyor to do an onsite investigation for the damage. Once the assessment is done, he is required to submit the report regarding the inspection to the insurance company. The insurance company’s further claim procedure will be done based on the surveyor’s findings.

SUBMITTING THE DOCUMENTS.

Providing immediate notification of loss or damage of goods and filing them make it easier for investigation. In some cases, the time limit is given up to one year to file a suit against shipping companies. Placing all the necessary document makes the claiming process easier.

THE DOCUMENTS NEEDED FOR MAKING CLAIM

• Original marine insurance policy/certificate.

• Copy of bill of lading (details of shipment like type, a number of goods, etc. )

• Survey report and findings made on site.

• Commercial invoice and packing list along with weight notes and shipping specifications

• Claim bill

Copies of all the correspondence exchanged with the insurance company and shipping company.

Additional documents include :

• Consignment note

• Container damage report

• Vessel outrun report

• Tally sheets

• FIR copy in case of theft

--

3movery useful 😀