The lending industry has always been competitive, even before the pandemic. Today, individuals can find payday loan companies online nationwide, not just in their local area. To compete for the business against other payday lenders, you must know how to get clients as a payday lender to get the new business you desire.

The trick is to showcase yourself as an authority in payday loans. You want to show your audience online that you are the right solution to their financing needs and that you make it easy to pay back the loan. When people look for emergency loans, they may feel vulnerable and unsure, so it’s your job to make them feel confident and comfortable in their decision to trust you with their needs for financing.

How to Get Clients as a Payday Lender

There are many ways to generate leads for payday loans, starting with narrowing your audience and understanding your target market and their loan needs. Next, you’ll build your brand, show your authority compared to big banks, and narrow your content strategy to find the ideal borrowers.

Use the following ten steps to learn how to get clients as a payday lender.

Define Your Target Market

To have a successful payday loan business, you must not waste time marketing to just any audience. The key is to develop relationships to get quality leads from people who need payday loans. You must narrow your target market and focus your marketing strategies on the demographics that could help you get more borrowers because you provide the right financing solution.

Get to know where your clients spend time, what advertisements they respond to, and how they prefer to communicate to grow your payday loan business.

For example, do you lend small payday advance loans for simple emergencies, such as those up to $500, or do you offer much larger loans? The amount you lend will determine your target potential customers and help you focus your marketing strategies.

Get to know what individuals within your demographic need, and find ways to build trust in the industry by implementing new marketing strategies. The more you narrow your audience, the easier it is to meet your demographics where they spend the most time.

Build Your Brand Recognition

Your potential borrowers want to get to know you before they talk to you, so it’s your job to show you are a confident and trustworthy character by providing relatable content online to get future business.

Most borrowers do their due diligence and look online before deciding which potential payday lenders to call to see if they fit their financial needs well. To reach your niche client, you must use digital marketing, building a brand identity that future customers can identify with and remember when they need online lenders.

To offer payday lending, you must build your brand with the following:

- Have a professional payday lender’s website with information about your loans

- Take advantage of social media marketing by being active on the social media platforms your audience uses

- Use proper SEO tactics to get your website and social media sites found at the top of the search results over other companies

Any marketing materials you create should have the same brand presence. This allows your audience to get familiar with you and to be able to recognize you whether they find your website, social media accounts, or a flyer in the mail.

Develop a Content Strategy

Content marketing strategies are the key to getting new customers and set you apart from others in the payday lending industry. As we said earlier, most people use the internet to research before contacting a new lender for loans. If they can’t find you online, it’s as if you don’t exist, whether you are an existing or new payday lender, and it will be hard to get new clients.

However, this doesn’t mean slapping together a website or making sporadic social media posts, as it won’t help you find more clients.

You need a strategy or a method to your madness to generate leads. Your content marketing strategy should have a strategy with relevant topics so you become the thought leader in the industry. A few ideas to include it in are:

- Create a payday lending blog – An up-to-date blog with valuable content helps potential clients find you. If your blog post contains relevant and helpful content, utilizes a keyword strategy, and helps current and future clients learn about payday loans, you may show up on the first page of the search engines, increasing awareness of your lending business. Your blog posts could be about how a short-term loan works or what to look for in a payday lender. This helps show you as a leader in the industry; just make sure they target the right audience.

- Consider videos or podcasts – Consider implementing videos or podcasts into your content marketing strategy about topics that may be easier to hear than read. Some people respond better to these materials than written blog posts, mainly to save time, giving you another avenue to get more borrowers.

- Network – Networking for payday lenders means talking to anyone who comes into contact with individuals who could use your services. This could mean online or attending networking events to find potential clients who need help with emergency loans.

Engage With Your Target Audience

Many lenders set up a social media page but don’t give it the attention it needs; that’s not proper social media marketing. They don’t engage with their followers to get new customers. To be a successful payday lender, you want to show that you are the expert your audience needs.

One of the best client engagement tips to get more clients is to give your social media pages a personal touch by showing behind-the-scenes footage or pictures of you getting involved with the community. Show your audience you are a real person who cares about your borrowers and the community, too.

The best way to do this is to interact with your audience. Most platforms like LinkedIn, Facebook, Twitter, and Instagram make responding to comments or direct messages easy. This is another way to get personal with your audience and let them know you are responsive.

This is important for most people when choosing a lender because they want someone they know they can communicate with easily and who offers a user-friendly process.

Leverage Referrals

Referrals are one of the best ways to find future clients. You can get a successful referral from satisfied existing clients, other business owners, friends, family, word-of-mouth, and even social media. Never be afraid to ask for referrals.

- From existing clients – If you have happy clients, they are likely to refer you to others. Create incentives for your current clients to provide referrals to their friends and family for your services and watch your client referrals increase.

- Business owners – Let business owners in the community know of your services. Even if they don’t use your services, they may come across others who can use your services, and they can refer you, or you can trade referrals to increase your client list.

- Friends and family members – Make sure everyone you know knows what you do and offer. You never know when they’ll come across someone who is a good fit for you and can refer them your way so you get a new client.

- Social media – Anyone can share social media posts, which will spread the word about your services without you trying. Create meaningful posts that people want to share, whether an existing client or someone who follows you, and you’ll get in front of a much larger audience without much effort and help you find new leads.

Network and Establish Relationships

The key to growing your client base is constantly networking. You can network online and in person if you attend networking events. In both areas, you want to create and maintain relationships. The key is to know your audience’s contact expectations and use that to your advantage.

Here are a few ways to reach more leads:

- Cold calling – Even today, cold calling is a popular way to build a payday lending business. If picking up the phone and making a cold call isn’t something you enjoy, focus your efforts on search engine optimization so your blog posts and other content marketing pieces reach the right business owners.

- Email marketing – Emails are the equivalent of cold outreach, but electronically. But just like you need a well-thought-out script for phone calls, your email marketing strategies must be strong to ensure your audience opens and engages with your emails. Just sending emails isn’t enough; without a strategy, they’ll likely end up in spam.

- Follow-up – Relationships aren’t built on one phone call or email. After the first contact with prospective clients, you must keep up the relationship by following up. This doesn’t mean following up and asking for the sale. Instead, continue providing value to your leads so you become a natural choice, and they possibly choose you over traditional banks or other lenders.

Utilize Targeted Advertising

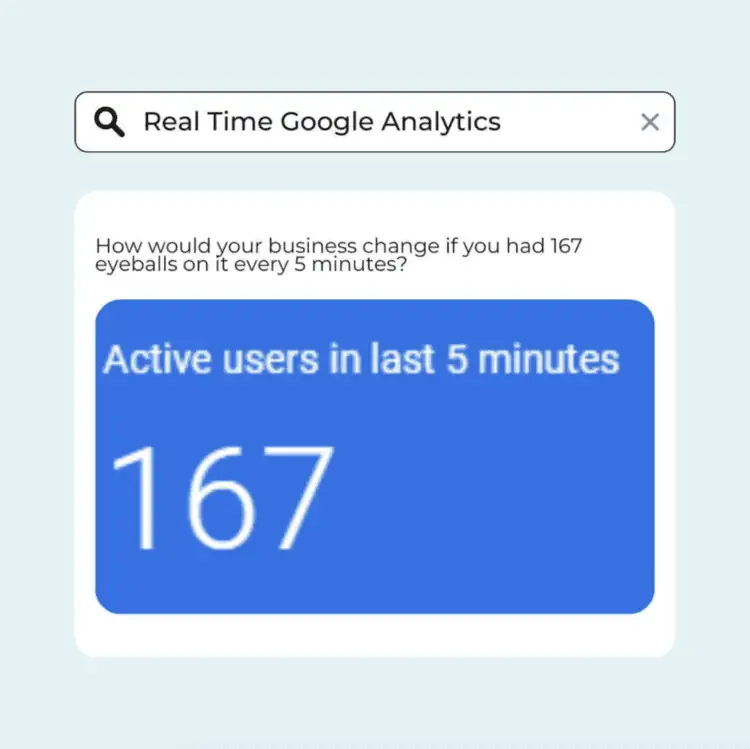

The internet and social media make it easy to target your advertisements. It’s different from the old days, when you would create an ad to throw on the radio or TV and hope it eventually reached the ideal client. With paid marketing, such as Facebook or Google ads, you can target the right demographics so only the people most interested in your services will see the advertisements.

You can also watch the analytics to see how your advertisements do, making changes to ensure the right audience sees your message.

Collaborate With Strategic Partners

Become the leader in a community, company, or anywhere else so you become the ‘go-to’ lender who provides what borrowers need. For example, create partnerships with other local businesses you can collaborate with and help each other market.

The key is to build authority to show your audience you are one of the best payday lenders in the industry that will provide them with what they need.

Speak at Business-Focused Seminars and Industry Conferences

Take advantage of opportunities to speak at events and speaking opportunities to get in front of people within your demographic. Use the opportunity to show the value of what you offer without selling. Provide sneak peeks of your services while providing valuable tips to your audience. You can also use this strategy online and offer a webinar to reach a larger audience.

Be Active in the Community

Community involvement is one of the best ways to show that you care about the people around you and that you aren’t just in business to make money. Attend as many local events as possible, offering free services, providing advice, getting your hands dirty, helping the community with a common problem or concern, and showing that you have common interests.

You can use the opportunities to volunteer your time or even offer free consultations to build relationships within the community. This works best when you join groups and get active in your community.

FAQs

How Do Payday Lenders Prospect New Clients?

Payday lenders have many ways to find potential clients, including content or email marketing, social media campaigns, and asking for referrals. The key to finding new borrowers is understanding your audience and who fits your target market best.

How Many Borrowers Should a Payday Lender Have?

Since borrowers are a one-time sale, you should always have a working pipeline of active leads. Some months will be better than others, but continually marketing to individuals will help you keep a running pipeline that always delivers.

What Type of Feedback Should Payday Lenders Seek From Borrowers?

Ask current customers what they think of your process, loan options, and whether you offer reasonable interest rates. Take the information they offer and use it to perfect your offering. This will get you new business and help increase customer loyalty for repeat borrowers and your referral business.

What Are the Most Effective Ways to Market a Payday Lender’s Services?

There isn’t a one-size-fits-all way to market a payday lender’s services. The proper method depends on the target audience. However, most lenders benefit from online marketing, including a solid content strategy and email and social media marketing.

What Platforms Should Payday Lenders Use to Reach Potential Clients?

Most professionals find borrowers on Facebook and Instagram. It’s also important to focus on platforms like Google Ads to get the word out to the right audience. The key is to narrow your niche and figure out where your target audience spends their time.

Final Thoughts

Knowing how to get clients as a payday lender is important as the industry grows. The stronger your marketing tactics become, the easier it is to be the authoritative figure in the industry. The key is setting yourself apart from the others and showing value to your new borrowers to help them choose your loan options over other bank loan opportunities.