Why is the U.S. Debt Expected to Keep Growing?

The Fletcher School, Tufts University | University of California, Berkeley and the Peterson Institute for International Economics

The Issue:

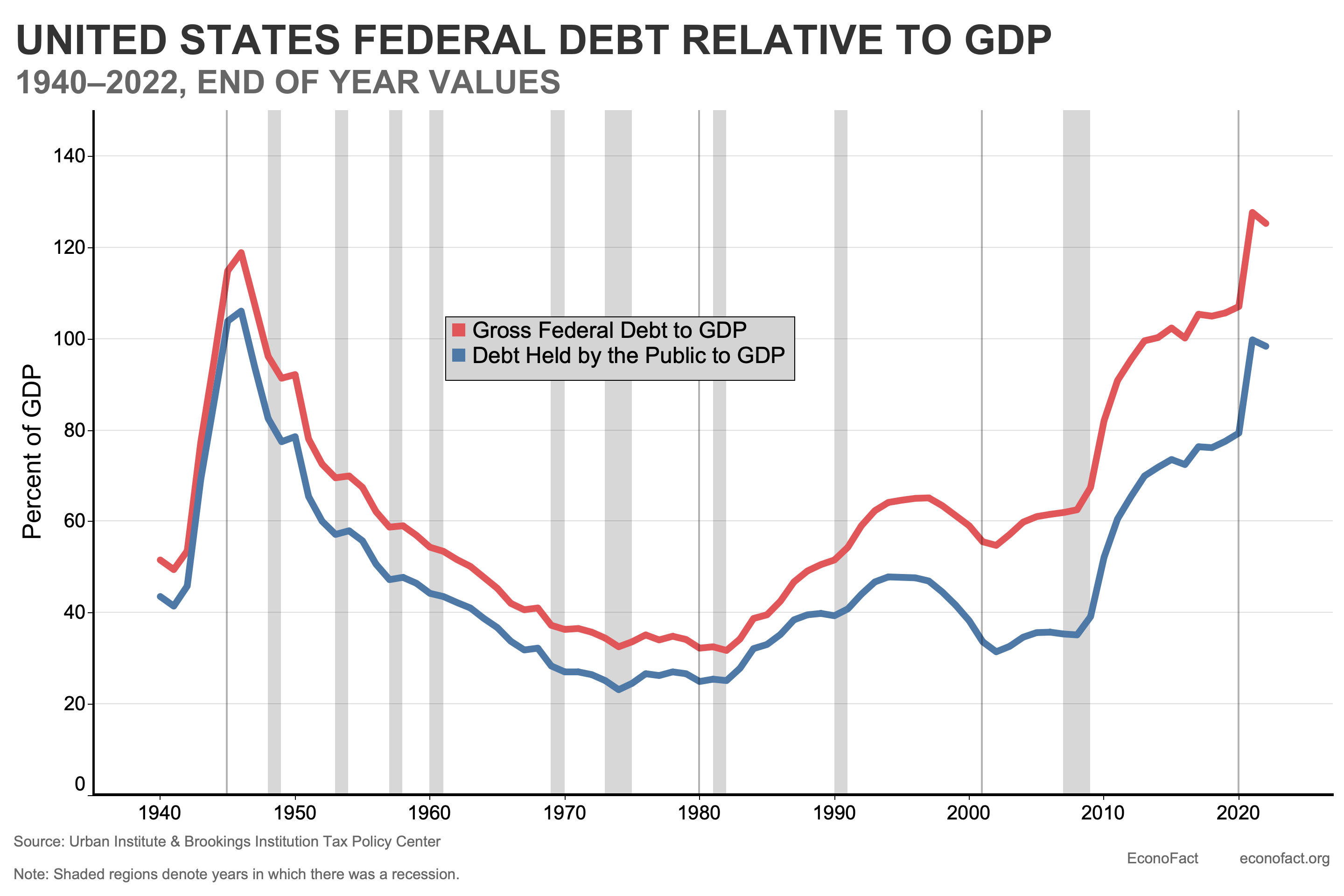

The United States Federal debt is the subject of ongoing concern and, during negotiations over lifting the debt ceiling, a source of political friction. Current debt levels are higher than at any time since the end of World War II. The Federal government debt in the hands of the public was 96.9 percent of Gross Domestic Product at the end of 2022, somewhat lower than it was at the end of 2021, but well above the 79.2 percent of GDP at the end of 2019, before the pandemic. Other economies similarly have seen spikes in public debt relative to GDP since the beginning of 2020, when the worldwide COVID pandemic led to rising public-sector deficits and slower economic growth. Despite the high-stakes negotiations around the debt ceiling, the U.S. Federal debt relative to GDP is projected to continue growing over the next decade. What factors account for this projection and why does it matter?

The CBO estimates that the U.S. Treasury will pay 3.9 percent interest on average on its 10-year borrowing in 2023 and 4.5 percent on its 3-month borrowing. These interest rates are up from 3 percent and 2 percent, respectively, in 2022.

The Facts:

- There are two main costs of a higher public debt. First, the government must pay additional interest on its debt, which may require it to raise taxes or cut expenditure programs. Second, if the economy’s saving flows into government debt, less is available to finance accumulation of possibly more productive capital assets, such as machinery, factories, and intellectual property. The level of publicly held debt as a fraction of GDP is a key ratio because the costs of any debt level are less important when the economy is larger. For a given level of debt, costs become less important as the economy grows because growth raises both the tax base and the flow of private saving. Conversely, a rising ratio of debt to GDP could signal lower economic growth. Historically, excessive debt-GDP ratios have sometimes led to financial crises in which governments may default on their debts, either through changes in repayment terms or through unexpected inflation. The government publishes statistics on its total gross debt and the portion that is publicly held. While the former is used in determining whether the government has exceeded its debt ceiling, and is often cited by the public (for example, in the U.S. Debt Clock), this includes money the government owes itself. The publicly held Federal debt is, therefore, the more relevant measure. (The figure presents data on gross debt and publicly held debt from 1940 to 2022.)

- The U.S. national debt is projected to exceed 100 percent of GDP in the next year or two. The rate at which the debt grows relative to GDP depends partly on fiscal policies, inflation, and real GDP growth. Nominal GDP is the denominator in the debt-GDP ratio, so when it goes up, either through real growth or inflation, the ratio of government debt (measured in dollars) to GDP falls. But GDP growth also influences the debt-GDP ratio through its effect on the government’s deficit. A government issues additional debt when its net revenue does not fully cover its outlays and the interest it owes on existing debt, creating a deficit. When the economy suffers a downturn, government borrowing normally rises owing to reduced tax revenue, higher automatic outlays on social safety net programs like unemployment insurance, as well as new discretionary spending and tax measures to support the economy. In turn, higher deficits make government debt rise more quickly. Then, as the economy recovers, deficits tend to fall, reducing the pace of increase in government debt. For example, the Federal budget deficit tripled from $983.6 billion (4.6 percent of GDP) in 2019 to $3,129 billion in 2020 (14.9 percent of GDP) during the sharp COVID recession, according to data from the non-partisan Tax Policy Center. As the economy recovered, the deficit fell to $2,775 billion in 2021 (12.4 percent of GDP). These deficits have added to the Federal debt and the Congressional Budget Office (CBO) forecasts debt held by the public to grow even more over the coming years, to 100.4 percent of GDP in 2024 and 108.9 percent of GDP five years after that (see Table 1, in the 10-year Budget Projections report for May 2023).

- The evolution of debt relative to GDP also depends on interest rates and prior debt. The overall deficit is the sum of government outlays net of tax revenues and interest paid on prior debt. Thus, the deficit today depends on how much borrowing the government did in the past as well as on the interest it pays on that prior debt and when that debt needs to be rolled over. Rising interest rates are raising the cost of new United States government debt. The CBO estimates that the U.S. Treasury will pay 3.9 percent interest on average on its 10-year borrowing in 2023 and 4.5 percent on its 3-month borrowing. These interest rates are up from 3 percent and 2 percent, respectively, in 2022 (see Table 2.1 in The Budget and Economic Outlook: 2023 to 2033).

- How has the United States brought down its debt-GDP ratio in the past after wars and national emergencies? The sharpest increases in debt-GDP ratios have historically occurred during national emergencies, notably wars, but these ratios have tended to fall rapidly thereafter. The rise in debt during World War II was especially dramatic, but the subsequent reduction in debt-to-GDP also was very rapid, with the ratio falling from 106 percent in 1946 to only 51 percent ten years later (and to a low point of 23 percent by 1974). That development owed to lower primary deficits, but also to a rate of nominal GDP growth that persistently outstripped the interest rates the U.S. Treasury had to pay. Between 1946 and 1974, nominal GDP grew at an annual average rate of 6.9 percent per year, whereas the average of long-term Treasury interest rates over this period (which generally exceeded short-term rates) was 4.05 percent.

- The U.S. debt-GDP ratio started to rise in the mid-1970s, far before the pandemic years. Over the years 1975 to 2019 as a whole, nominal GDP grew annually by 6.0 percent on average, while the average 10-year Treasury interest rate was higher, at 6.27 percent (short-term interest rates were mostly lower, but the overall cost of debt was closer to nominal GDP growth than before 1975). Debt relative to GDP rose as primary deficits increased. In part, the rise in Treasury borrowing costs over this period reflected financial-market liberalization, which forced the Treasury to compete with private borrowers. The amount of debt in public hands outside of that held by the Federal Reserve would have increased even more through 2019 had the Federal Reserve not purchased substantial Treasury debt itself starting in 2011 to stimulate the economy following the 2007-09 financial crisis (“publicly held debt” includes debt held by the Federal Reserve). U.S. interest rates rose somewhat after 2015, but then were slashed again by the Federal Reserve as a new recession emerged in February 2020 due to COVID-19. Since March 2022, however, the Federal Reserve has raised interest rates rapidly in an effort to combat the post-pandemic inflation.

- A permanently higher debt-GDP ratio after recovery could pose risks. The United States is open to foreign capital inflows. Given the high foreign demand for Treasury debt, the effect of higher U.S. public debt by itself on the cost of domestic capital investment would be somewhat muted by more foreign purchases. However, other economies have also been running big fiscal deficits, and collectively, the United States and other countries could exert stronger upward pressure on government borrowing rates. This process will be strengthened as, additionally, central banks raise interest rates to fight inflation and reduce their balance sheets by selling government bonds. The most recent IMF Fiscal Monitor, from April 2023, points out that fiscal retrenchment can support monetary policy in the effort to bring down inflation, but warns that this would involve difficult policy choices about which budget items to cut in order to minimize harm to vulnerable populations. For example, in the United States, safety net programs such as the Supplemental Nutrition Assistance Program have been targeted by some in Congress even though they represent a relatively small part of the overall Federal budget and are far less important than entitlement programs such as Medicare for future long-term sustainability.

What this Means:

Facing historically low unemployment rates, a tight labor market, and an upsurge in inflation unprecedented since the 1970s, U.S. macroeconomic policy swung in 2022 from supporting the economy in the pandemic recovery to a much tighter monetary policy and reduced fiscal stimulus. Spending caps contained in the recent Fiscal Responsibility Act, which raised the debt ceiling until 2025, will restrain any discretionary fiscal expansion in the near term, even if the U.S. economy slips into recession soon as a result of the Federal Reserve’s monetary crunch. However, a recession would still raise the government deficit through the action of automatic stabilizers (such as lower tax revenue for the government), likely raising the debt-GDP ratio even if the Fed cuts interest rates. Furthermore, those cuts might be slow in coming if inflation does not fall more quickly than it has been toward the Fed’s 2 percent inflation target. It is not hard to see why the CBO is predicting higher debt-GDP ratios over the next decade, with the debt projected to reach 118.9 percent of GDP by 2033, slightly more than 20 percentage points higher than its projected value at the end of this year. Whether the ratio of U.S. Federal debt to GDP will stabilize eventually depends on interest rates, inflation, the U.S. economy’s growth – and most importantly, the ability of Congress and the President to agree on policies that sustainably reduce government deficits.